Bitcoin (Bitcoin) from the 2025 annual open to Thursday’s Wall Street trading session as markets reacted to US jobs data.

Key points:

-

Strong US labor market data failed to dampen hopes for a Federal Reserve rate cut in December.

-

Cryptocurrencies continue to move away from stocks amid expectations of a strong end to 2025 for the latter.

-

Bitcoin has multiple key resistance levels that must be reclaimed in order to reverse the bearish status quo.

The Fed has no “choice” on whether to cut interest rates

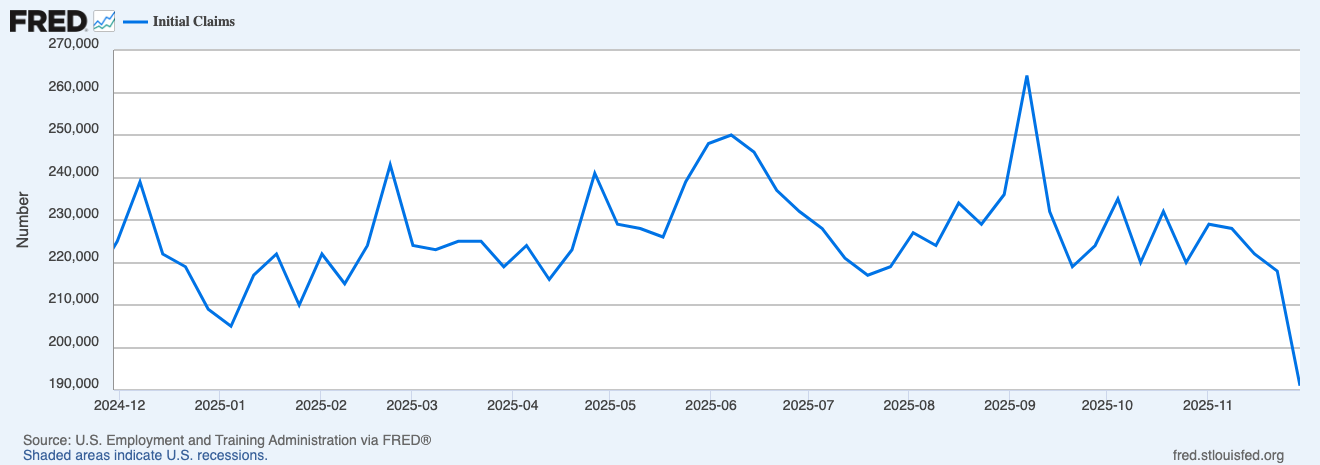

Data from Cointelegraph Pro Markets and TradingView Bitcoin price action showed weakness due to surprisingly low US unemployment claims.

Both initial and continuing claims came in below expectations on the day, according to data from St. Louis Federal Reserve Bank.

Despite this, this indicates a strengthening of the labor market, and thus the flexibility of markets Doubled Amid expectations that the Federal Reserve will cut interest rates at its meeting on December 10.

The analysis believes that the reason is the widening gap between risky assets and consumer power.

“The Fed has no choice: Even when inflation reaches 3%, the Fed must cut interest rates to ‘save’ American consumers,” trading source The Kobeissi Letter wrote in its issue. Latest comment On X.

“Consumers suffer as Big Tech stocks rise. More interest rate cuts are coming in one of the hottest stock markets in history. Own assets or leave them behind.”

The reduction would theoretically support more liquidity flows into cryptocurrencies and risk assets. like Cointelegraph reportedEven the risk of raising interest rates in Japan in the near future represents a contradictory move, as its central bank has finished pumping economic stimulus worth $135 billion.

Qubaisi described Japanese status as “free for all”.

“Japan prints stimulus, but raises interest rates? Something is off.” Sum it up In addition to printing standard 30-year bonds.

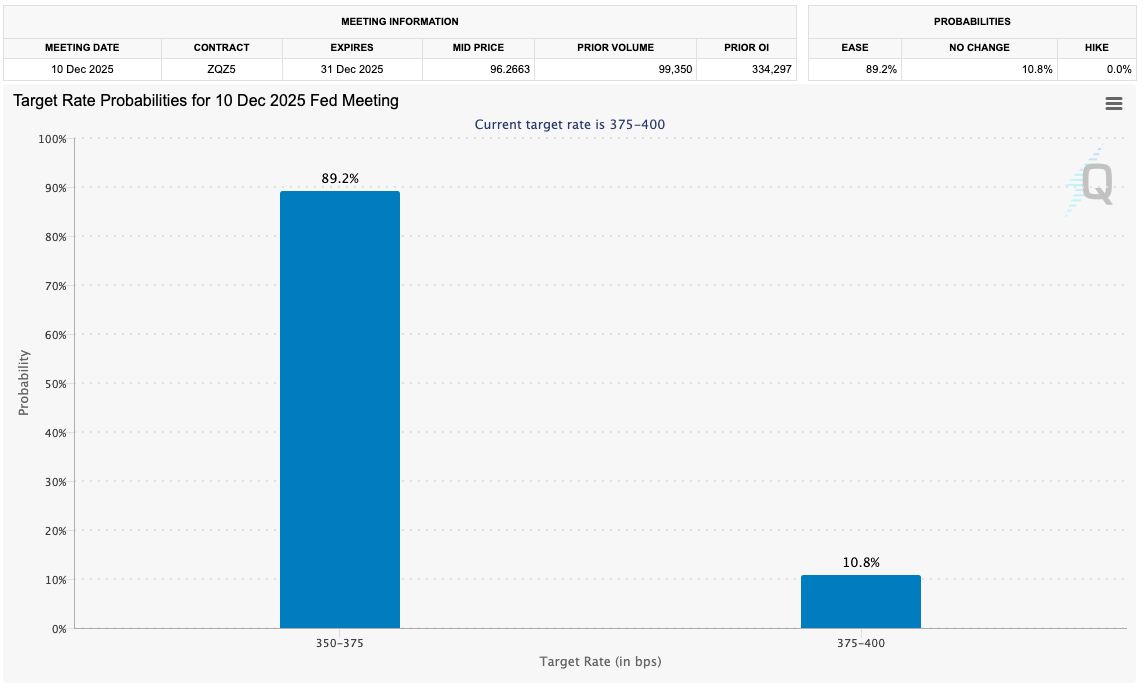

Continuingly, trading firm Mosaic Asset warned that future Fed rate cuts are not guaranteed despite market optimism.

“While market implied odds point to an 89% chance of a third straight rate cut, deep divisions emerge over the future path of interest rates,” the bank wrote in a note. Blog post per day.

“While this may lead to volatility in the stock market, the underlying market internals are developing very favorably for a rally through the end of the year.”

Analysis: Bitcoin’s decline case ‘remains strong’

With the S&P 500 just 0.5% below new all-time highs, Bitcoin and altcoins continue to emerge as weak players.

Related to: Bitcoin increasingly looks like it did in 2022: Can BTC Price Avoid $68K?

Among traders, there are multiple resistance levels that need to be reclaimed on the horizon.

Besides the annual open of $93,500, points of interest included liquidity closer to $100,000, as well as the 50-week simple moving averages (SMA) and exponential moving averages (EMA).

“We look for a retest at the 50-week SMA, but need to clear resistance in the $96K-$98K range first,” Trading Resource Material Indicators He said X followers along with a chart of Binance order book liquidity data.

“It is too early to call this a bull market recovery. We need to clear these resistance levels with a strong RSI at the weekly close before we can have this conversation.”

In a Later postMaterial Indicators said Bitcoin’s failure to flip the yearly open so far was “an indication that the bearish thesis remains strong.”

previously, Cointelegraph reported On various BTC price indicators that seek to draw a line under the recent bearish phase of the market.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness or reliability of any information contained in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.