Another day, printing other huge profits from pregnancyThe largest source in the world. The company recently released its latest “interest”, its authenticity was validated by BDO under ISAE standards. Here is the link for those who like to read ratification reports!

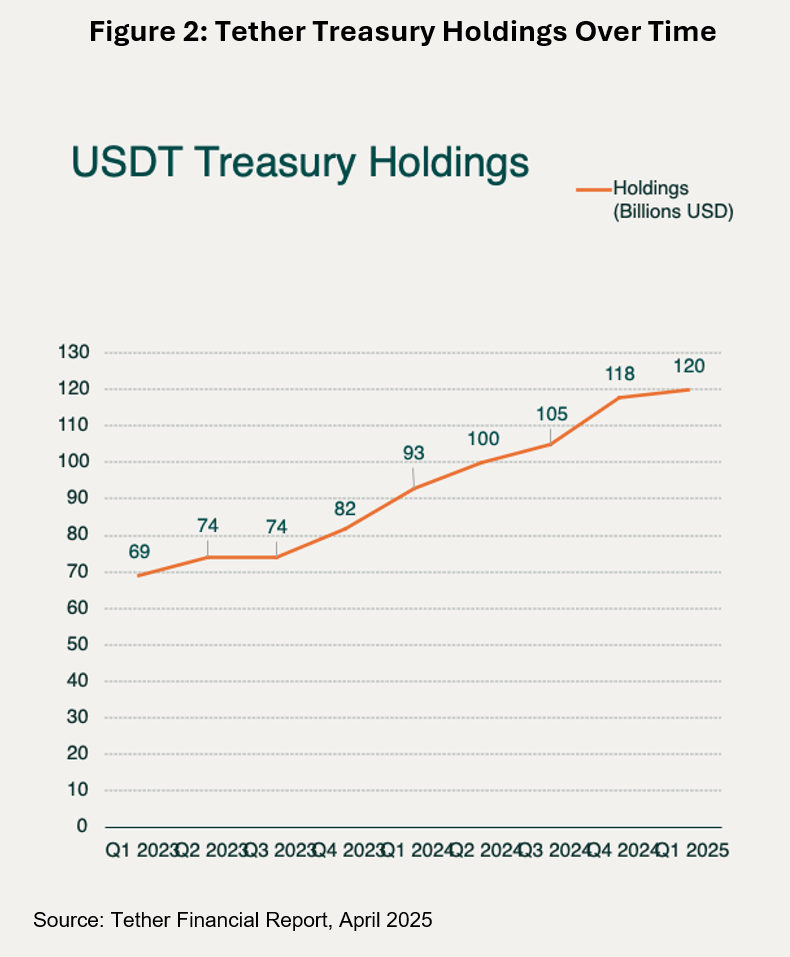

In short, the report shows that Tether quietly grown to the tyrant. Tether has $ 149.3 billion of assets, including $ 121 billion of treasury bills, cash rewards, and short -term deposits. What’s more, Tether produced $ 852 million of net profit in the last quarter (after paying stock profits). It also carries a surplus of excess reserves that total about $ 6 billion and invests in Bitcoin and launches new initiatives, including Tether AI (more about that later in the newsletter).

Now, the company turns its focus into the United States after years of work abroad in the first place. According to the company, the new symbol will work under the supervision of the United States. This point confirms, it was said that CEO Paulo Erdino has participated with American legislators, including Senator Bill Hajri, to agree with the proposed Stablecoin legislation.

As a reminder, Stablecoins are 1: 1 digital symbols by FIAT SCESERVE, which were primarily designed in US dollars. It revolves around the open Blockchain networks, allowing an immediate low -cost and global access to liquidity in dollars.

But besides enabling digital payments, they became clear buyers of US Treasury bonds.

Tether’s invasion in the United States is not just a sign of Crypto’s rehabilitation in the eyes of the US government, but it is also a sign that Stablecoins can become a strategic financial infrastructure for the United States – if Congress can pass legislation that would accelerate adoption by consumers and companies alike.

As a reminder, Stablecoins are 1: 1 digital symbols by FIAT SCESERVE, which were primarily designed in US dollars. It revolves around the open Blockchain networks, allowing an immediate low -cost and global access to liquidity in dollars.

Those efforts suffered from a setback when a group of democratic lawmakers who supported by the Republican’s Stablecoin legislation, known as the genius law, supported them (at the present time), which led to some doubts about the law quickly. At the present time, this appears to be a stumbling block on the road to greater regulatory clarity.

People close to the case told me that Trump’s attempts to rude to enrich himself using encryption were granted Democrats and some Republicans, stopping. We have long confirmed that these president’s attempts to benefit from Crypto are actually undermining legitimate efforts to pass the laws of profit.

The timing is important here. We have previously discussed how traditional foreign buyers of American debt – Japanese pension funds, European mutual, and even central banks – have begun to decline. If these buyers have long give up the question, the question becomes: Who will finance the increasing financial needs in America?

Stablecoins will be part of the answer – just ask Paul Ryan or Scott Bessin, who were audio supporters.

In fact, Stablecoins, which is based on Blockchain is now among the best US government debts-which exceed countries such as Germany and Australia-and grow quickly. According to the Tether’s Q1 2025 report, approximately 82 % of its reserves are held in US Treasury bonds, re -boxes, and money market boxes with indirect exposure to the treasury.

Can Stablecoins also appear as a tool for cash diplomacy – a way to show the US dollar worldwide without the need for material banks or correspondence networks?

Today, billions of people lack reliable access to the dollar, not because they do not want it, but because the old infrastructure is not accessible. Stablecoins can fit. With only a smartphone, anyone can store, send and settle in digital dollar in actual time.

After years in the border exile, Tether’s transfer to North America may be equal to organizational clarity and an increase in the capacity of the United States -based financial institutions, the demand for stablecoins and experiences in this field. If Stablecoin’s exporters such as Tether are adopted as a legitimate financial actor, they can play a much larger role in the financial system.

This week, Tether also announced that she was ventured in the world of artificial intelligence. Tether AI, according to the CEO of Paolo Ardoino, is “fully open source AI’s operating time, able to adapt and develop on any devices and device, there are no applications of application programming interface, there is no central point of failure, full and compatible, and its purpose of WDK to enable USDT and Bitcoin.”

This is completely mouth. To date, the details are limited. But in the spirit, we believe that artificial intelligence and encryption are intuitively linked.

For example, in January, we wrote about how Amnesty International “agents” such as Chatbots, apparent aids and commercial robots, using Cryptoassets like a digital bank account.

This is logical and the driver can be the most difficult for encryption. The number of artificial intelligence agents may exceed human beings soon, but unlike people, they cannot enter a bank, open an verification account, start a company, or enter a legal agreement. The only way for them to conduct transactions, transportation, value storage and formation of binding work relationships is to use Cryptoassets and a set of tools on the series of smart contracts and DAOS.

Therefore, the artificial intelligence system where people and agents alike can handle immediately and feel a look by USDT and Bitcoin in a way that is directed, even if the details are mysterious at the present time. We will monitor that.

Alex Tuscot is the administrative director of the digital asset group, a section of NinePoint Partners LP. He is also the author of “Web3: Drawing the following Economic and Cultural Borders on the Internet. Subscribe to his news message, Digst digital assets.

|

You want to be the first to know about interesting Blockchain currency Investment ideas? Subscribe to receive free Street reports Newsletter. |

Subscribe |

Web3 NinePoint Web3 is generally exposed to the following risks. Refer to the Fund’s simplified facility bulletin to obtain a description of these risks: There is no guarantee in achieving investment goals; Investment loss risk of active management; The risk of focusing the risk of assets category; Blockchain risks of cryptocurrency risk; The danger of sabotage innovation; The risk of emerging technologies. The risk of telecommunications services companies; The risks of information technology companies; The risk of liquidity is the risk of stock of stocks; General risks of foreign investment; ETF units trading price; Stopping the trading of securities held by the NinePoint Web3 Innovators Fund. Small company risks; Specific source risks; Trading price for basic money risks; The risks of the derivative tool; The risk of securities lending; Dependence on the manager; Care director and maintenance; A possible conflict in interests; Evaluation of the Creators Fund at NinePoint Web3; Currency risks; Exposure to American currency; The risks of great security personnel; There is no royal interest in the portfolio; Changes in legislation; The risk of inflation is not a cybersecurity risk confidence company; Covid-19 outbreak; Tax risks.

Leave responsibility: information and/or materials mentioned in this email and any attachments derived from sources believed to be reliable when sent, but accuracy or completion of the information is not guaranteed. Opinions, estimates, expectations and/or recommendations mentioned in this email and any attachments are the author’s opinions from the date of this, and are not given or supported by any of ninePoint partners LP unless it is independently confirmed by NinePoint Partners LP.

Opinions, estimates and expectations (“Information”) mentioned in this report are only the author’s opinions and are subject to change without notice. The author makes every effort to ensure the derivation of information from sources believed to be reliable and accurate. However, the author does not bear any responsibility for any losses or damages, whether direct or indirect, which arises from the use of this information. NinePoint is not under any commitment to update or keep the current information here. Information should not be considered an alternative to their rule. Please contact your personal advisor in your own circumstances.

The views expressed should not be considered in relation to a specific company, security, market sector or market sector as an indication of the intention of trading for any investment funds run by NinePoint Partners LP. These opinions should not be considered an investment advice and should not be considered a recommendation to buy or sell.

The information here does not constitute an offer or a request by anyone in the United States or in any other judicial state that is not allowed to allow such an offer or a seam or any person who is illegal to make such an offer or a seam. Potential investors who are not residing in Canada must contact their financial advisor to determine whether the funds for funds have been legally sold in their competence.