The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Football price for lion and players soft. All Arcu Lorem, Intrimies, any children or, ulamcorper, hate football.

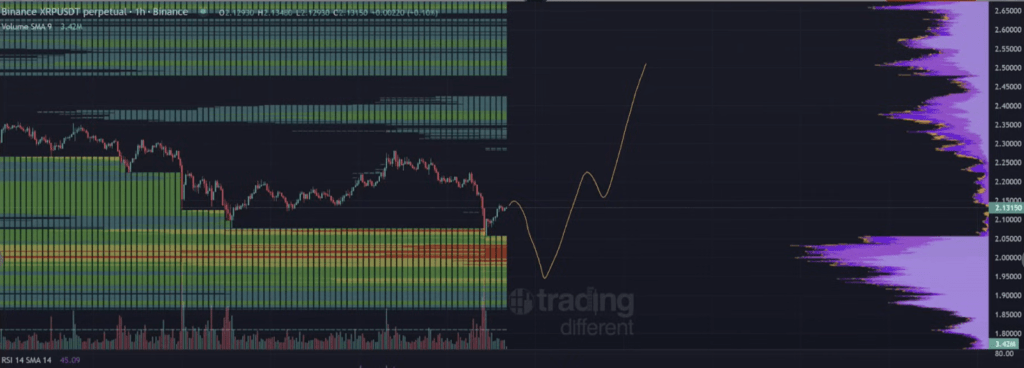

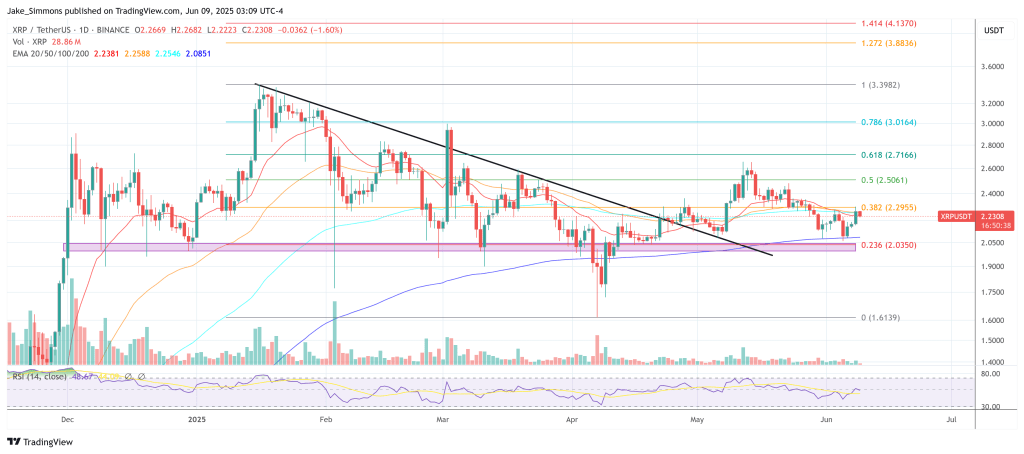

Cryptoinsight pseudonym has warned that the next main step for XRP may be a trap. In a video posted on June 8, the scenario analyzed with a rising XRP about 2.30 – 2.40 dollars in the short term – only to violently oppose the flow of sharp liquidity before any sustainable fracture.

XRP Bull Trap waving on the horizon?

“I think XRP goes to $ 2.0. He saidHe added: “He can come and sweep the height here … he can like, $ 2.30, and then pushes us down. It will be more painful to everyone, because everyone will think we are going to the upward trend.”

The preparation that describes it depends on the structure of the market and liquidity dynamics, especially the accumulation of comfort orders under the current range of XRP. He said, “This is here a source of concern, a real concern for me,” referring to the growing liquidity group without the current prices. According to its internal models, such as this Liquidity It was statistically touched “80 % of time”.

Related reading

“Someone is trying to deceive someone here,” warned. “I am careful.” Although the near XRP-it is mentioned that it is “95 %+, it may be more than 98 %” in XRP-Cryptoinsightuk confirmed that it is not rooted for correction. He said, “I don’t want to go down.” “I just show you what I see.”

The analyst suggested multiple structural tracks: one in which XRP explodes immediately, and another where it gathered briefly to sweep the local heights before it flows down to form a rise spacing. He said, “We are in a scope now.” “Do we come, sweep the highlands, then take its lowest levels and go?”

He clarified the loud difference pattern that he watches, as the price is a decrease in low while the relative strength index (the relative power index) printed a higher decrease – a preparation that it uses to determine the bottom structures. “This is what I would like to see,” he explained.

The wider total circumstances are still supportive

Despite the declining tactical preparation, the video hit the optimistic macro tone. You will cite four incentives in the short term: the genius law on Stablecoin control, The deadline for the entry of Washik In SEC treatments against Ripple, July Resolution A window for the ETF Spot-XRP suggestion, and a renewed expectation of the distinguished financial policy sparked by the Trump Musk dialogue that was broadcast last week.

“What really tells us is that there is a financial print,” he said. “The assets will explode all over the upper side, and for other specific reasons, the XRP may be better.”

By moving to Bitcoin, the analyst noticed a continuous decrease in trading volume, indicating frequency or fatigue. “There was no folder. There was nothing,” he said about the last BTC price procedures.

Related reading

The most prominent a CME future gap About 92000 – 93,000 dollars added that the fixed range analysis indicates a potential decline area at 96,000 dollars and 97,000 dollars. “It may come quietly, perhaps this week,” he said, with a scenario in which BTC decreases in this range before resuming its upward path.

“Does this mean that we press the upper direction or go down and take this matter and put in the structure of the upward divergence?” He asked, pointing to a similar spacing preparation of $ 75,000 earlier this year.

Spot XRP activity raises red flags

In the last hour before the video, XRP was “some size pressed”, but the analyst urged caution. While the open interest has risen sharply, the financing has been green – the selection of long, clear sites has been determined – the total premium has turned red. He said: “This indicates to me that although there are still some short pants, more pants have entered.”

He warned that this imbalance may cause a sharp step if the market fails to keep current levels. He said: “If we arrive now and we lose this low, we expect a more aggressive and faster transition to the negative side,” noting the risk of liquidating positions.

The proportional performance of XRP against ETH and BTC also reviewed. Although it has begun to test the resistance areas, it did not explode XRP/ETH or XRP/BTC plans decisively. He warned, “We can still be a cut in this range.” “It may lose strength until we start seeing some assurances on the upward trend.”

At the time of the press, XRP was traded at $ 2.23.

Distinctive image created with Dall.e, Chart from TradingView.com