The GPU market, especially within the artificial intelligence sector, is experiencing explosive growth, with models such as the upcoming NVIDIA H100, B100 and RTX 4090 that faces massive demand. NVIDIA account and networks alone More than $ 26 billion in quarterly dollars for Q2 2024-growth of 154 % on an annual basis. This increase in demand led to a significant scarcity, which makes it difficult to obtain these graphics processing units, but also expensive for rent. Despite these challenges, people are ready to pay a suitable access, indicating strong return capabilities for those who can provide these resources effectively.

This is at the intersection of AI and GPU and technology on the chain that can affect decentralized physical infrastructure networks (DePin), in our opinion. By providing effective and uncontricane financing solutions, DePin can take advantage of the unbelievers demand on high -performance graphics processing units, turning the bottleneck into a profitable investment opportunity. In addition, the original encoded mechanisms-such as lending, return speculation, and even self-paid loans-can enhance the capabilities of the return on GPU, which leads to new revenue flows for investors and participants in the ecosystems alike.

In this sophisticated market quickly, DePin provides a strong framework for canceling value lock by obtaining capital sources efficiently, and placing it as a major player in the future of the infrastructure for artificial intelligence.

The GPU financing life cycle, which focuses on AI, consists of several distinct stages, each with unique challenges and characteristics, and not all suitable for full decentralization or implementation on the chain. The graph below shows the five main steps in this value chain and depicts the suitability of each of them to implement the series.

The first step, FinancingIt is a pioneer use of the encryption space. Either through investment capital, symbolic sales, knot sales, symbols that carry the return, or loans, there are many installed methods to raise the capital to acquire graphics processing units. Placement of financing on the chain has two main applications. First, access weakens, allowing a wide range of investors to participate. The purchase and operation of a group of graphics processing units requires large capital graphics units – hundreds of thousands of dollars – and secondary exposure through stocks provides more indirect exposure to less productive assets. Second, encryption financing allows speculation, which often leads to an increase in higher assessments of actual basic assets or “risk -free value”, especially in the case of one -time increase and symbolic sales.

Instead, making the financing part of the product itself through loans or direct “purchases” of graphics processing units by user on a continuous basis is a more flexible and short -term development option. However, this approach may provide less control, long -term security, and the project team corridor.

Once the money is raised, the following steps –Purchase and operation One of the graphics processing units-is generally more suitable for implementation outside the chain. These stages are often combined and its source of the same entity (for example, entities provide computing resources for a network and operate graphics processing units themselves) and share similar properties. While decentralization and a broader variety of service providers can provide benefits, the advantages of economies in implementation outside the chain exceeds this. Outside the chain solutions reduce the costs of purchases and operation and make it possible to provide low -cumin GPU groups, which is necessary for certain applications and is difficult to achieve through more distributed and loose networks. In addition, since these material assets, some ingredients outside the chain at least will be always required to operate them.

GPU resumption Customers and bills management in theory, can theoretically implemented on the chain, which reduces the dependency of the third party and enables the distribution of the return in the actual time. However, the benefits of this approach are limited to simply compared to the solutions outside the chain. More importantly, many customers may not have encryption systems in place, which may create unnecessary barriers. The hybrid solution-the use of encryption under the cap with providing a user experience similar to other infrastructure platforms such as the IAAS service.

finally, Reducing the generated return Returning to investors is very suitable for local encoding, with many good -tested solutions. From the distinctive symbol of shrinkage and purchase mechanisms to LP codes bearing access and self -payment loans, the distribution of the return on the chain provides great advantages to alternatives outside the chain. Not only this provides unique opportunities, but also the possibility of “supporting” the return with additional sources of Defi, speculative strategies or symbolic emissions. These additional returns can be directed alongside the offer to attract more investors and aspect of demand for alternatives outside the chain.

In the next section, we study the potential returns for such a product, using NVIDIAAS AI Slide, a commercially successful AI chip, H100, as a case study. The total return can be divided into three components:

Total return = productive return + symbolic return + DEFI

The types of return are defined as follows:

- Productive return Is the yield obtained directly from renting graphics processing units:

On the contrary, expenditures include operating costs, external fees, taxes, decreased value of devices and protocol fees. The yield component is largely separated from the encryption market itself and less speculative.

-

Distinguished symbol revenue Is the return obtained by the distinctive symbol emissions from the project:

TVL refers to the closed total value in the complexes that earn these emissions. These gatherings can include distinctive licenses, loan pools, or the original symbol pools. This type of return is highly dependent on the performance of the project, the design of the distinctive symbol, and the emissions schedule, and it is usually associated with the conditions of the overall encryption market and therefore more expensive.

-

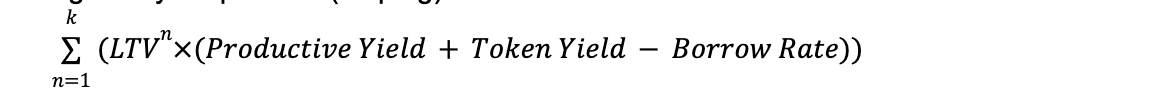

Defi return Is an additional return be generated by leverage by borrowing over and over again against your position (episodes):

LTV refers to the loan ratio to the value of your lending position, and K is the number of rings. A recent example of the shaving of the throat is borrowing against USDE for Morefu, using the borrowed amount to buy more American wheel and repeat the process. This yield component works as a double in the current return and is very speculative and risky. It is also “optional”, and not all investors will choose to carry the additional risks, especially the risk of filtering, but also the risk of additional protocol or nails in the borrowing rate.

Scenarians and assumptions

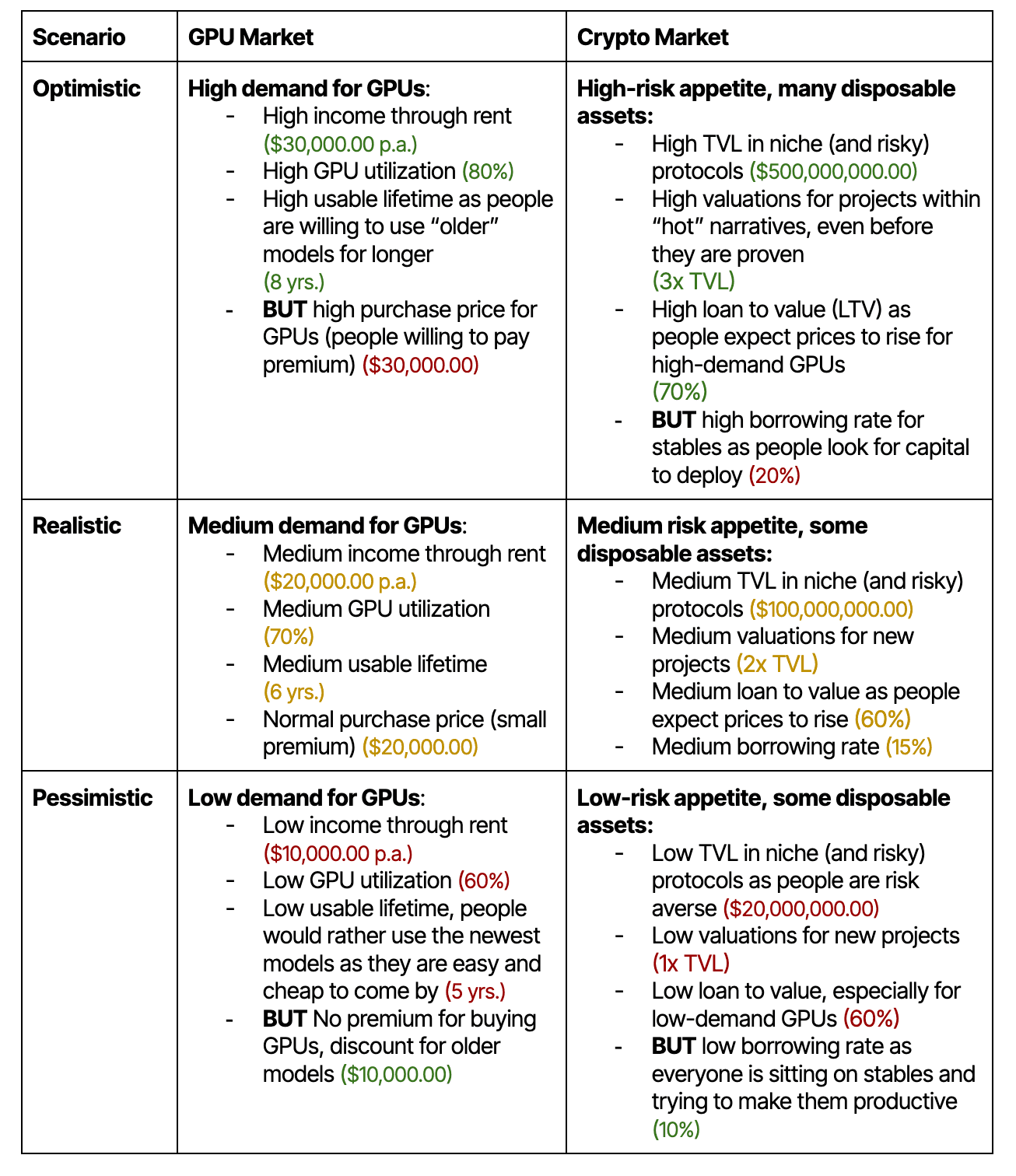

Given the current uncertainty in the technology and encryption markets, this report will present three different scenarios –Optimistic, medium and pessimistic– From focusing on one case. These scenarios differ in the following ways:

- GPU market conditions (Purchase price, rental prices, use, and User GPU’s age) affects the productive return.

- Code conditions for the encryption (TVL, TVL to FDV Multiplier, LTV, borrowing rate) affects the distinctive symbol returns and Defi.

The following table depicts the assumptions of each scenario, based on the H100 graphics processing unit. The model protocol that has been studied for this simulation is metastrent, which leads the financial distribution of GPU, leasing and return.

Other assumptions needed for the working status, which are fixed in all scenarios, are:

- Operation costs: ~ 5’300 dollars per unit (electricity, cooling, maintenance and support, operational infrastructure)

- expenses:

- 10 % protocol fees

- 10 % additional fees (third parties)

- Distinguished symbol emissions:

- 10 % of the offer in one year across all swimming pools, distributed evenly for each TVL unit

- Defi Credit:

- 5 episodes, providing a good balance between the marginal increase in the return (about 10 % range for the fifth episode of the joint LTV) and the ease of relaxation in the position.

- Episodes: borrowing stables against your assets (in this case your “share of GPU”) at LTV at the borrowing rate, deposit them in the complex, and repeat them.

results

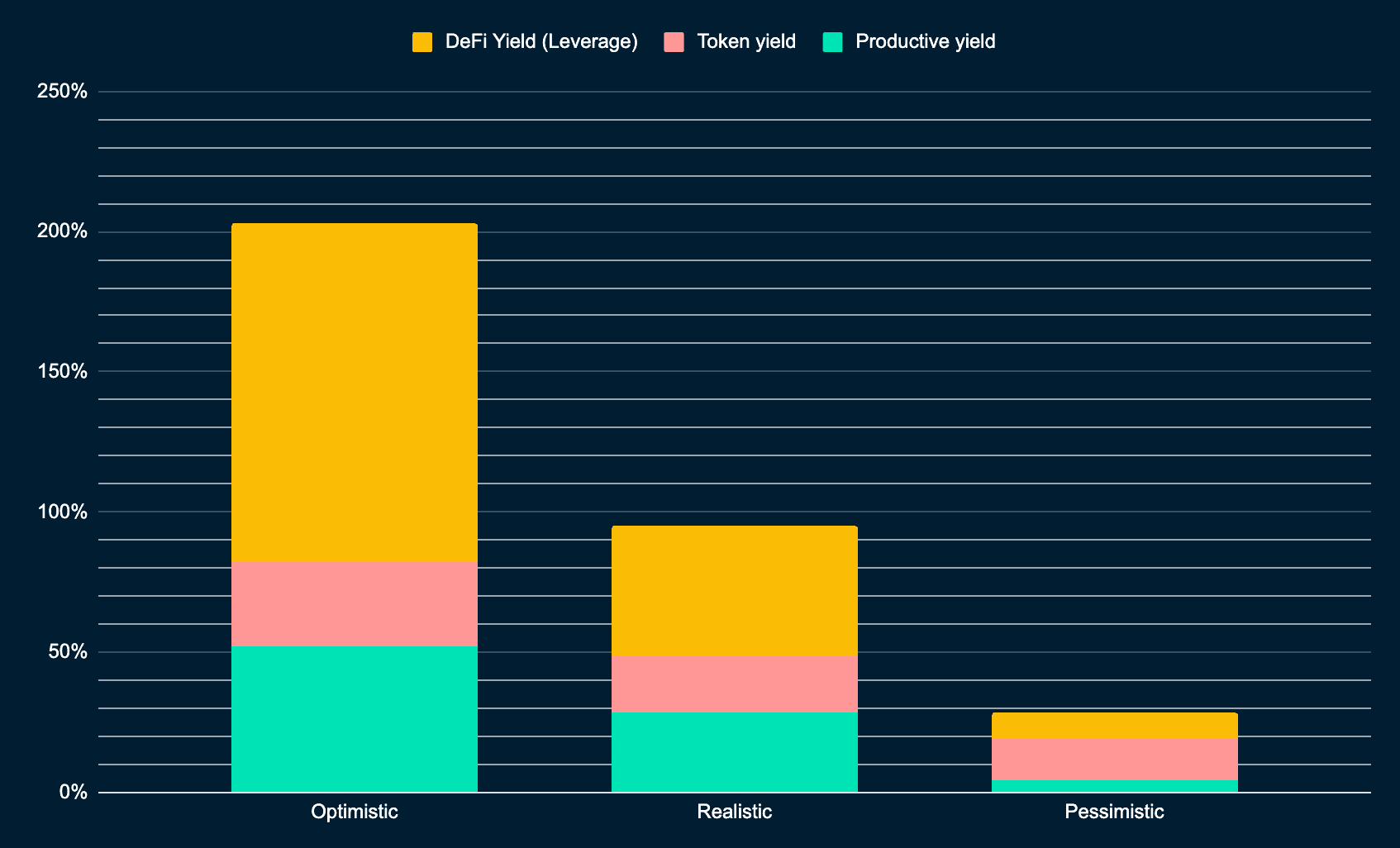

Finally, the graph below shows the resulting returns for each scenario, a division into the components of the three return.

In the most suitable scenario, both for encryption markets and GPU/ AI, APR can be imagined about 200 %, especially when using the leverage through Defi. However, taking advantage of influence always carries the risks, especially in the hot market conditions. Even without lifting, the returns of about 80 %, which consist primarily from the production return, represent a very attractive investment opportunity.

In the realistic scenario, the use of about 95 % April, or less than 50 % may only consider the productive return and the distinctive symbol. With about 30 % of the productive return, this condition still provides strong returns.

Even in the pessimistic scenario, APR still is about 28 % with a leverage capable of competing, and even without more Defi integration, approximately 20 % appear to be a realistic. However, in this case, the majority of the return comes from the distinctive symbol emissions, leaving slightly more than 4 % in the production return. In the long bear markets, this may not be sufficient to maintain the value of the distinctive symbol in the long run and the return may completely collapse.

In general, even in unfavorable conditions, the probability of converting profit appears to be reasonable if it works in one scenario. However, most projects are likely to have a mixture of different scenarios over their life, which may lead to more extreme results.

For example, the financing of GPU groups or a full project during the bull market – when GPU prices and high installments – through the direct bear market can lead to a mixture of low low rates and low revenues. Although current public feelings indicate that we are in a realistic scenario, this shift may be harmful to investors, especially in the short term and when using the leverage.

On the contrary, the purchase of graphics processing units on a reduced discount during a pessimistic scenario, then entering the emerging market can push APRS effective to be further than 200 %, especially if the acquired codes are not sold and continue to estimate them. Thus, GPU’s timing can play a decisive role in profitability, given the inherent volatility of the basic asset.

For the chances of return other than USD, nodefi can save up to three attractive yield numbers. For dollar revenues, while the current return of GPU rental is already impressive, the ability to enhance profitability by combining these rents with distinctive symbol emissions and large Defi strategies and can be decisive in obtaining an advantage against competition outside the chain. This may even be in the pessimistic market scenario, as the usual rush may decrease towards rapid assets on money, such as distinctive symbols. The ability to generate strong and sustainable returns under these circumstances highlights the flexibility of the DePin -backed GPU financing.

However, realizing this capabilities requires overcoming many important obstacles. The complexity of precise preparation, evaluation, accounting, and mobility in legal frameworks makes this type of investment more complicated than direct tools, such as treasury bills.

In addition, effective implementation is essential to success in this advanced field, and whether the project can successfully manage these challenges in the long term.

However, it appears that a few prominent candidates are in a good position in this field. Projects like Render, Nosana, Atehir and IO focus more on mediation in revenue/ rent and contract. Meanwhile, Metastrett extended its positions to high -capabilities sections of chain of value, symbol and financing, thus taking advantage of Defi and Token’s revenues, the highest productive return. These projects provide a promise that these large revenue capabilities can (partially) be brought to the series, creating a profitable and developmental environmental system for decentralized artificial intelligence.

Slip: Nansen produced the following report as part of his current contract for services provided to Metastreeet (“” customer “) at the time of publication. While Metastrett has the right to review and make notes to Nansen, Nansen maintains full editing control over the publication of this report. All opinions expressed are independent opinions of Nansen’s (analysts) analyst, which are the author (the author) called this report. This report is for media purposes only and does not act as an investment, financial, professional or last advice. For more information, please refer to the evacuation of responsibility at the end of this report, as well as our service conditions.