The Bitcoin Fund on the Blackrock menu in the United States scored its largest exterior flow since May, where Bitcoin fell during the weekend and regained a little on Monday.

Blackrock’s Ishaares Bitcoin Trust (Ibit) witnessed an external flow of $ 292.5 million on Monday, which is the largest in two months. There was also a slight flow on Friday, that he had finished a 37 -day flow chain.

Reflexes come as a captain (BTCIt fell further from that from its highest level all the time during the weekend, as it declined by 8.5 % to the bottom to $ 112,300 on Sunday before recovering to $ 115,000 late in trading on Monday.

The last Blackrock flow is Blip compared to A. Pink From $ 5.2 billion in July, which represented 9 % of the net flow of ETF since its launch in January 2024.

Related to: Blackrock Ishares Bitcoin ETF exceeds 700 thousand bitcoin

Bitcoin etfs spot cooling

It is now the third day of the trading day that was sold at Bitcoin Investment Conferences in Bitcoin in the United States.

The Bitcoin Fund wisely in Foundelity outperformed about $ 40 million, and Bitcoin Trust (GBTC), while the rest of the United States -based products witnessed zero flows on Monday regardless of BitWise (BitB), which saw a $ 18.7 million flow.

It seems that external flows slowed down as the original wore support levels at $ 112,000; On Monday, ETF Exodus was a Tamer from Friday, $ 812 million.

Digital origin stealing market share

The largest image appears to be more healthier for the products of the institutional digital assets this year.

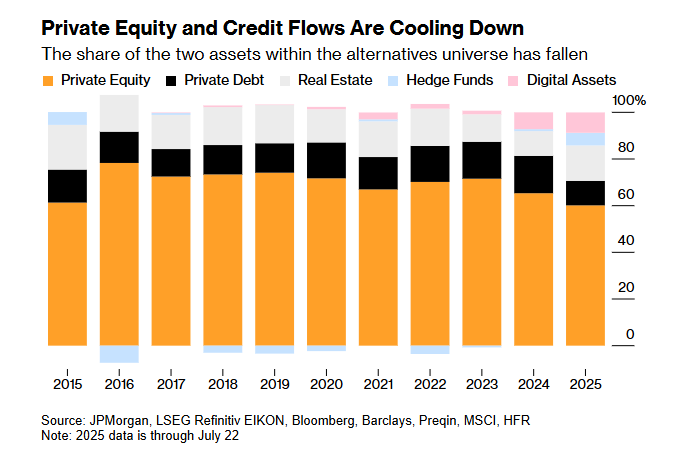

Bloomberg expert Etf Eric Balchunas I mentioned On Monday, while the boom of private assets cools, digital assets and hedge funds on the market this year were stolen.

“Within the chapters of alternative assets, digital assets and hedge boxes were witnessing an acceleration of this year’s flows, on a sharp contradiction with the collection of weak donations in private stocks and private credit.” He said Bloomberg.

Capital flows The report indicated that digital assets are the fastest growing sector in the alternative market, adding that the category attracted 60 billion dollars until July 22, after a record worth $ 85 billion last year.

Investment funds circulating volatility

Sonas also He said On Monday, bitcoin volatility has calmed down since the launch of Spot BTC ETFS.

90 days spin fluctuations for the Blackrock IBIT box less than 40 for the first time. He added that more than 60 years when the investment funds circulated in Bitcoin were launched in January 2024.

Since the launch, there is a lot Lower fluctuation “There are no criticisms that stimulate vomiting,” last week, before adding: [BTC] Attract the largest fish and give it a fight of fighting to adopt as a currency. ”

magazine: China mocks American encryption policies, new dark markets in Telegram: Asia Express