Main meals:

-

Web3 daily activity was established steadily at 24 million in the second quarter of 2025, but the sector’s formation turns.

-

Defi leads the census of transactions with 240 million weekly, however the use of ETHEREUM gas is now dominated by RWA, DePin and AI.

-

Smart contracts, DEFI and RWAs are outperformed in the market, while artificial intelligence and DePin are late despite strong accounts.

Altcoins is more than speculative stakes on metal currencies outside Bitcoin. In most cases, they represent – or aim to represent – specific activity sectors within the Web3, which is an inhuman alternative to the old Internet and its services.

The evaluation of the state and the capabilities of the Altcoin market means looking beyond prices. The main indicators such as the use of gas and the number of unique active transactions and wallets (UAW) helps measure activity and adoption, while the performance of currency prices reveals whether the markets follow the directions of Onchain.

AI and Social DAPPS acquire adoption

UAW is a distinctive address that interacts with DAPS, which provides an agent for the expansion of adoption, although multiple portfolios for every user and automatic activity can distort results.

The DAPPRADAR Q2 2025 report shows fixed activity of the daily wallet at about 24 million. However, the shift in the dominance of the sector is emerging. Crypto games remain the largest category, exceeding 20 % of the market share, although it is down from the first quarter. DEFI also slipped, as it decreased to less than 19 % of more than 26 %.

On the contrary, social and artificial scientists acquire traction. Farcaster leads socially with approximately 40,000 UAW per day, while in Amnesty International, the virtual (virtual) protocol is highlighted, as it attracts 1900 weeks per week.

Defi attracts big players

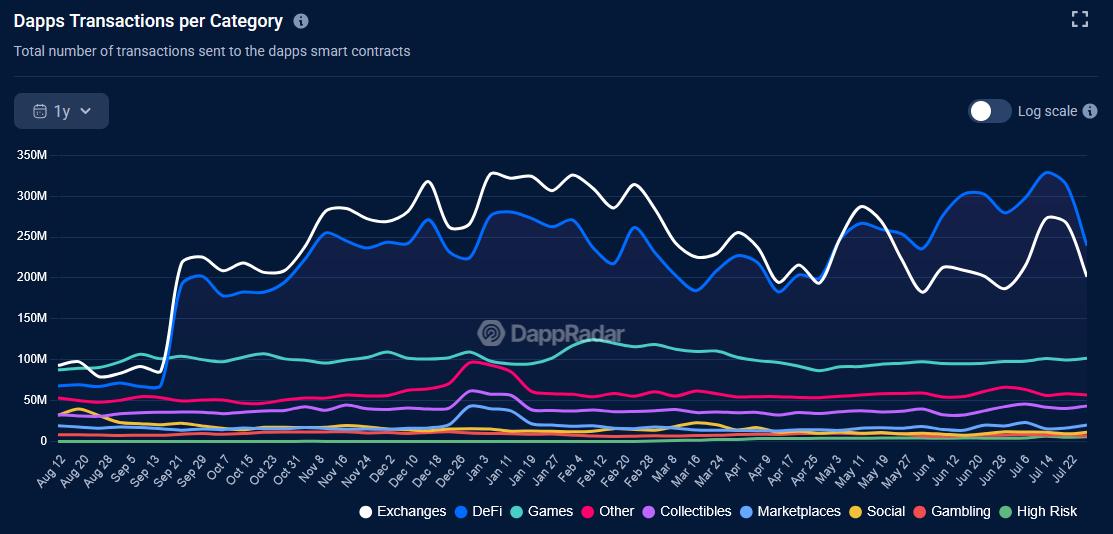

The enumeration of transactions shows the number of times that smart contracts are run, but can be amplified by robots or automation.

DEFI is contradictory. Its user base has decreased, however it still generates more than 240 million weekly transactions – more than any other web3 category. The exchange activity (can interfere with Defi) add this domination, with encrypted games in 100 million weekly transactions and “other” category (with the exception of social but including artificial intelligence) at 57 million.

The total closed value (TVL) tells a stronger story. According to Defillama, Defi TVL amounted to $ 137 billion – an increase of 150 % since January 2024, although it is still less than $ 177 billion in late 2021.

The difference between TVL and Falling UAW height reflects a major topic for this encryption cycle: Institutional Press. The capital is focused on a fewer largest portfolio, which now also includes money. This trend is still young, as Defi faces organizational uncertainty in many judicial states.

However, the institutions are tested by water by providing liquidity for dissolved gatherings, and associating against the distinctive treasury of platforms such as Oondo Finance (Oondo) and MAPLE (Syrop), and the other is also known to its partnership with the Cantor Fitzgerland Investment Bank.

Meanwhile, automation at the protocol level provided by Defi services such as Lido (Lido) or EignLayer (Eigen) increases the wallet activity, as Defi develops into a capital saving layer directed towards generating the return on a large scale instead of retail sharing.

Other use cases dominate gas

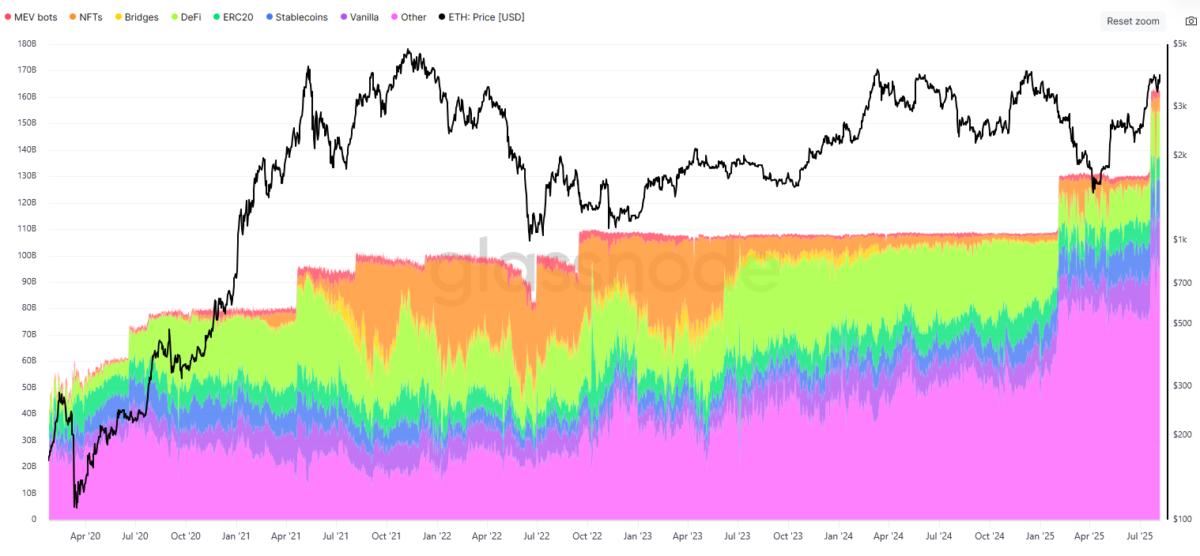

The transaction data alone does not take the full Web3 image. The use of Ethereum gas can be explained where the economic and calculation weight is truly.

Glassnode data reveals that Defi, although it is the main sector of ETHEREUM, is now only 11 % of its gas consumption. NFTS, which used a large share of gas again in 2022, now decreased to 4 %.

However, the “other” category increased to more than 58 % of about 25 % in 2022. This category covers the emerging areas such as the asset code in the real world (RWA), decentralized physical infrastructure (DePin), and DAPPS based on artificial intelligence and other new services that may determine the next growth stage on the web.

RWA is often referred to, in particular, as one of the most promising coding sectors. With the exception of Stablecoins, the total value of RWA increased from $ 15.8 billion at the beginning of 2024 to $ 25.4 billion today, with an estimated 346,250 distinguished code holders.

Do prices follow Web3 novels?

Asset prices in Lockstep rarely move with ONSAIN activity. While the noise can push short -term screws, the continuous gains tend to compatible with sectors that offer concrete benefit and accreditation. Over the past year, this meant the infrastructure and projects that focus on the return exceeding the plays driven by the narration.

The smart nodes ’platform currencies recorded the most powerful gains, with the best 10 percent 142 % unwanted, led by HBAR (+360 %) and XLM (+334 %). As the basic layer of Web3, their price growth indicates the investor’s long -term development confidence in the sector. DEFI symbols also achieved a well, with an average of 77 % on an annual basis, with a DAO (CRV) curve by 308 % and Penle (Pendle), an increase of 110 %.

The first ten codes have gained 65 % on average, paid xdc (+237 %) and OSG (+137 %). The best DEPIN, Jasmycoin (Jasmy) performance at +72 % and ATHir (ATH) at +39 %, were unable to prevent the average sector from about 10 %.

Artificial intelligence symbols were clearly delays: the 10 best projects focused on artificial intelligence decreased by 25 % on an annual basis, with the only prominent Bittensor (TAO) in +34 %. Game symbols have mostly deployed losses, with superb (Super) only 750 % in the past 12 months. Social symbols are still largely absent in the encryption space, as leading protocols still lack the original origins.

In general, the Web3 investment remains focused in the mature sectors, which increases the original currencies of leading smart contracts. DEFI and RWA symbols that focus on the return on solid returns. On the other hand, the sectors behind most of the excessive novels – Amnesty International, DePin, and Social – have not yet been translated into meaningful symbolic gains.

With the deepening of adoption and the maturity of more sectors, the gap between narration and performance may be narrow – but at the present time, the investor’s confidence is clearly rooted in building blocks in the decentralized economy.

This article is intended for general information purposes and does not aim to be and should not be considered legal or investment advice. The opinions, ideas and opinions expressed here are alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.