Key takeaways

How dominant is Ethereum over DeFi right now?

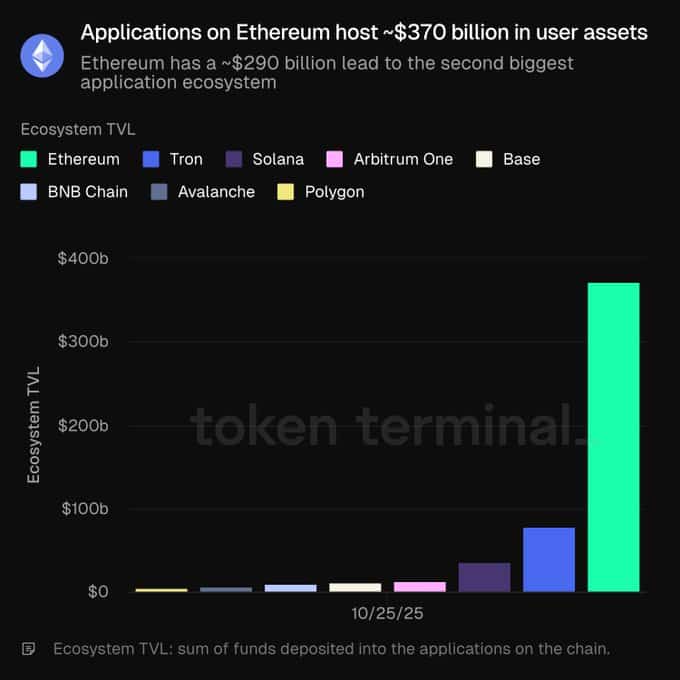

Ethereum commands over $370 billion in user assets, about $290 billion more than any other blockchain.

What supports Ethereum’s market cap?

Token assets and stablecoins on Ethereum often set a minimum valuation for ETH, keeping their market value stable.

Ethereum [ETH] The dominance in DeFi remains unparalleled. Applications built on its network now secure more than $370 billion in user assets, nearly $290 billion more than any other blockchain.

As stablecoins and token assets grow, Ethereum remains fundamental to the industry’s growth.

Ethereum supplies lead

Block chain She continued to dominate Decentralized applications, with about $370 billion in user assets locked across its network. This represents a massive $290 billion advance over the second largest ecosystem.

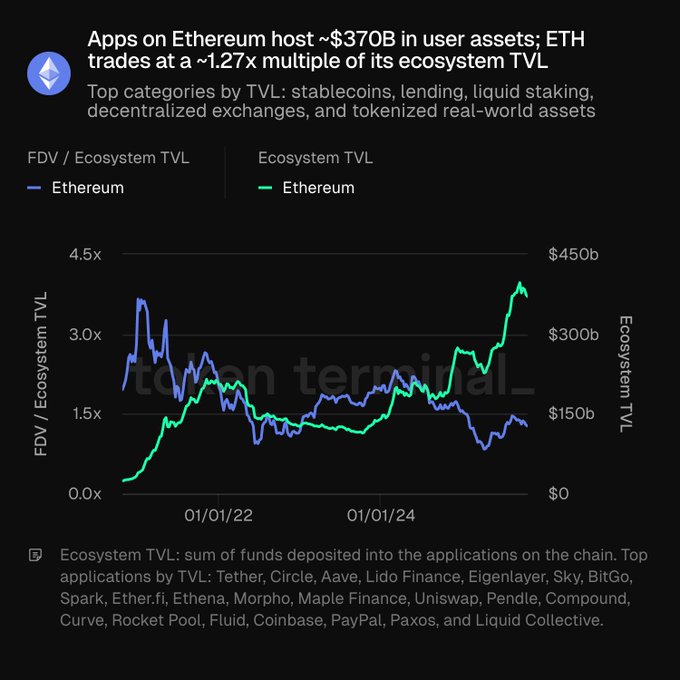

Data from Token Terminal showed that Ethereum’s total value locked (TVL) has risen alongside growth in stablecoins, lending protocols, and token RWAs.

network Traded At a rate of 1.27 times the value of its ecosystem, despite increasing competition from… Solana [SOL], You see [TRX]and resolution [ARB].

Token assets stabilize the market value of Ethereum

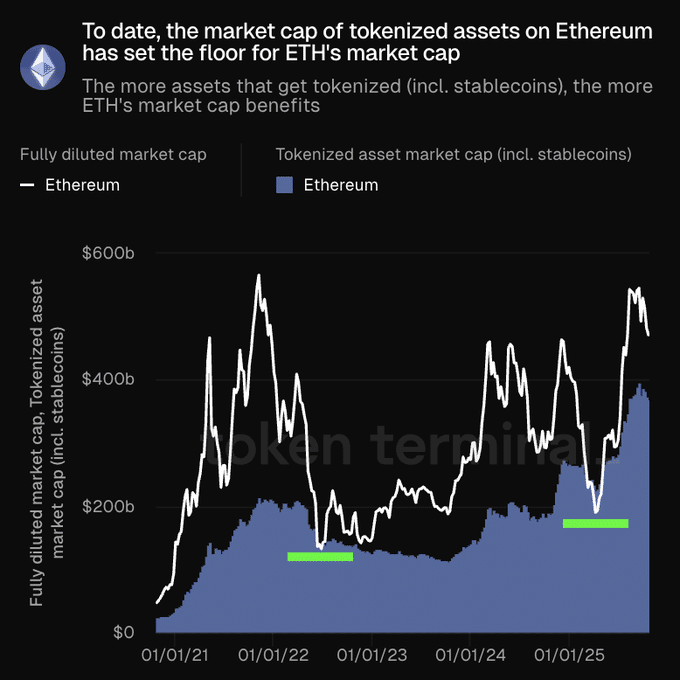

Data showed The market cap of token assets on Ethereum (including stablecoins) often determines the minimum total value of ETH. As more assets are issued and traded across the chain, Ethereum’s market capitalization usually rises along with it.

The chart also showed that the growth in token asset value, seen in early 2022 and mid-2025, corresponds closely with the recovery in the fully diluted market capitalization of ETH.

Momentum slows as buyers lose steam

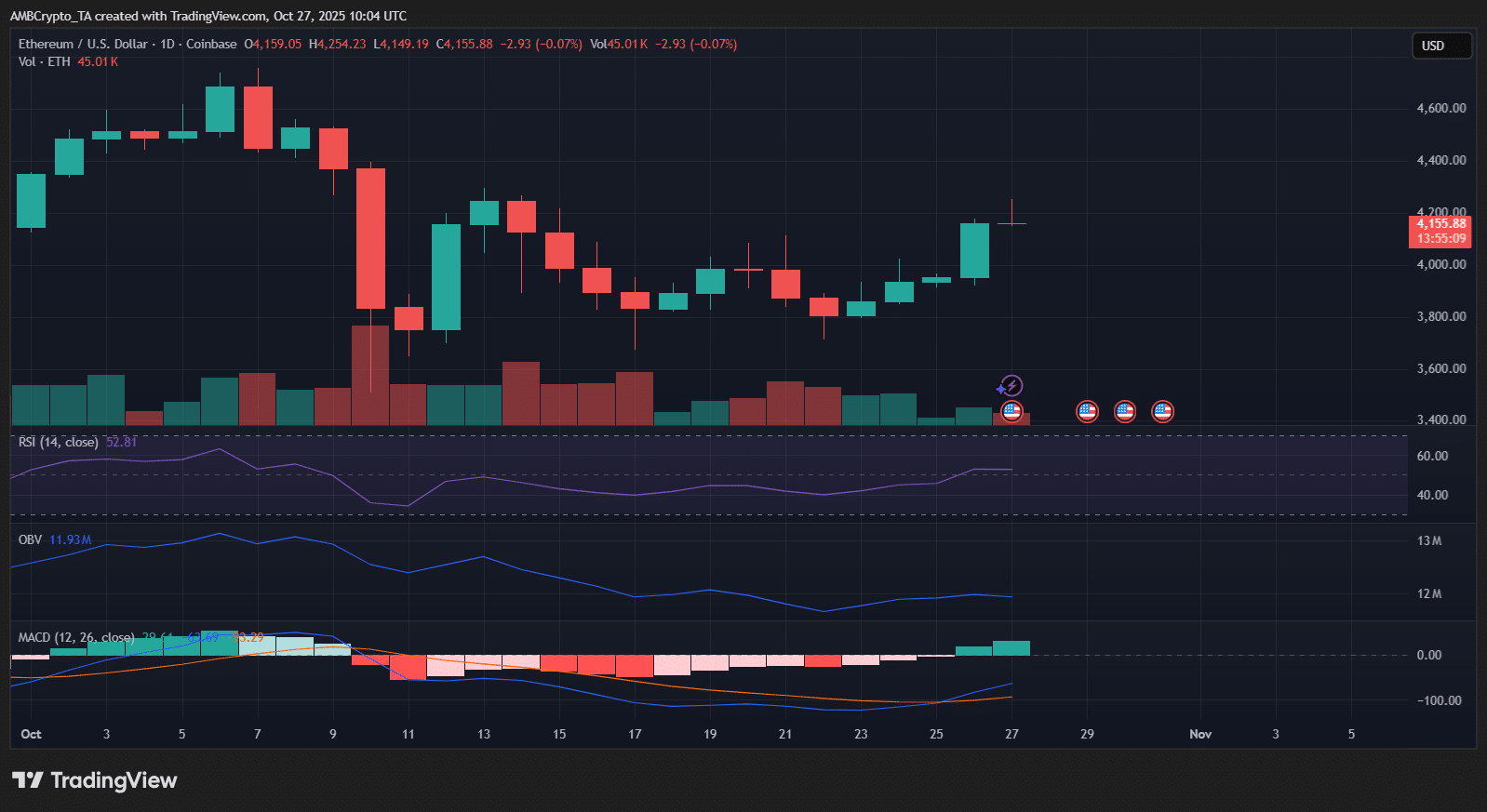

At press time, Ethereum It traded at $4,155 after briefly testing resistance near $4,200.

The Relative Strength Index was at 52.8; Neutral momentum after cooling from overbought conditions earlier in the week. Meanwhile, the MACD showed a moderate bullish crossover, but fading green bars on the chart meant that buying strength was weakening.

Meanwhile, OBV held steady at 11.9 million, so volume support for further gains may have been limited. With numbers pointing to consolidation, ETH is struggling to maintain bullish pressure near short-term resistance.