Main meals:

-

A hidden declining contrast on the RSI hints to weaken the bullish momentum of Bitcoin.

-

The CME gap can be between 114,000 – 115,000 dollars as a magnet.

-

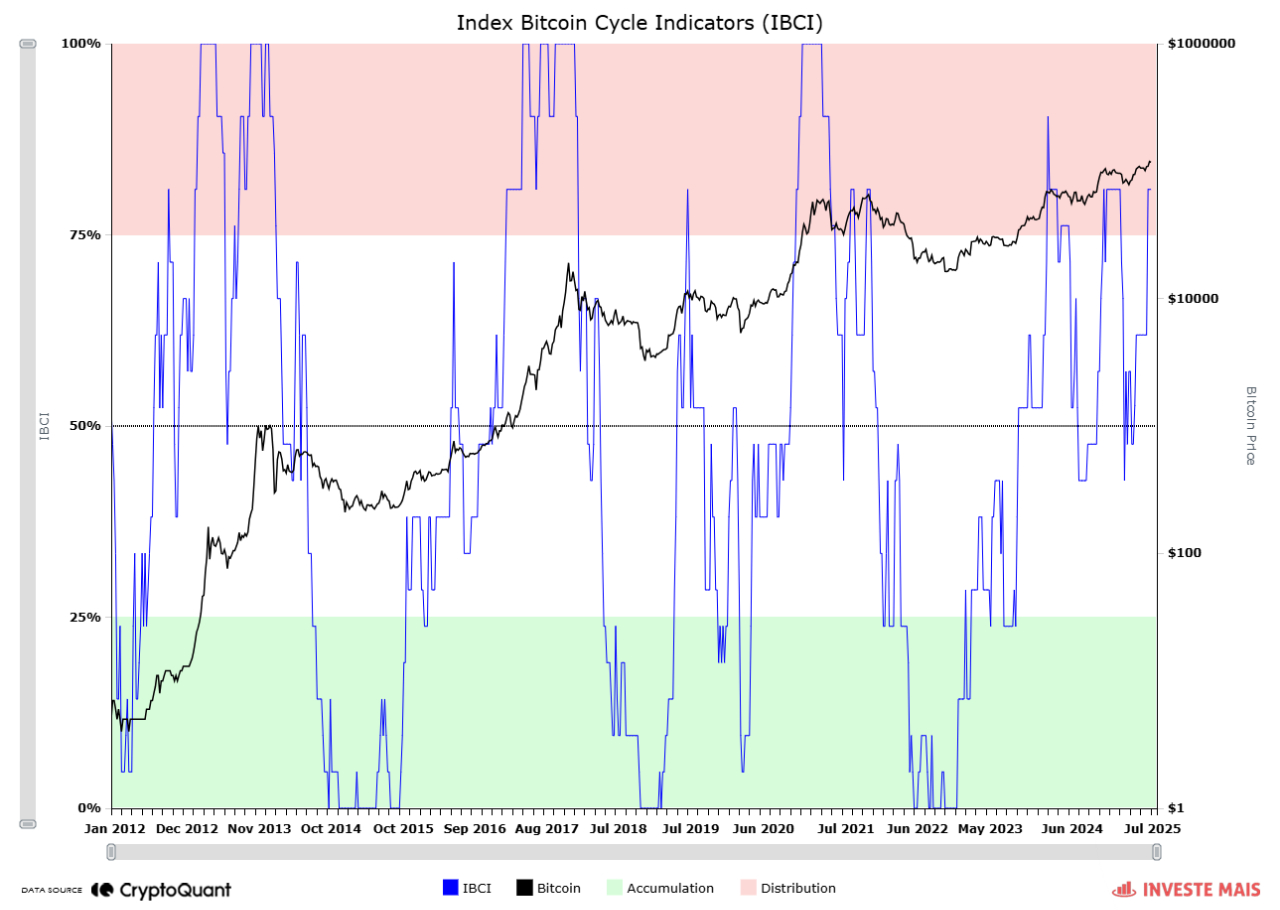

The market patrol and a variety of bitcoin indicators appear in the distribution area.

Bitcoin (BTCSigns of possible weakness appear, with three critical plans indicating the possibility of new weekly decreases in July. While the long -term trend is still intact, merchants must prepare for the short -term fluctuation.

Bitcoin currently displays a hidden declining difference between its price and the RSI index, a momentum that measures the strength of price movements.

The hidden declining difference occurs when the price is made its highest level, but RSI constitutes its highest levels or less. This difference is alluded to poor momentum behind the assembly, which often leads to negative corrections.

This same pattern appeared in March 2024, and then Bitcoin The price of 20 % decreased in the following days. Likewise, the constant difference may lead to another corrective step, and possibly pushed bitcoin to its lowest level in the short term.

BTC CME GAP waves on the horizon as a negative magnet

The CME gap is located between 114,380 dollars and $ 115,635 on the daily chart. CME gaps are formed when Bitcoin is trading outside of regular hours on Excination Mercantile Chicage (CME), leaving price voids that are often filled in active trading sessions.

These gaps are important because historical data shows that Bitcoin tends to “fill” her, meaning that prices may restore to cover the unlawful range. In 2025, seven of all nine CME gaps were already filled, with only this gap and the smaller gap between 91,970 dollars and $ 92,450 is still open.

The high mobilization rate on Bitcoin’s chances of reviewing these levels, which leads to a short -term decline to close an arc of $ 114,000.

Related: Traditional companies enter Crypto Treasury with Buys BTC, XRP and Sol

Bitcoin in a distribution area

Anonymous encryption analyst GAAH male Bitcoin Index (IBCI) indicators have entered the distribution area, a area historically linked to euphoria in the market and temporary summits. This is the third income in the current bull cycle.

The analyst explained that although the index not only touched the lower base of the area (80 %), not the peak (100 %) that were seen in the peaks of the previous session, the reading is still a warning signal. The main indicators such as Puell Multips and Sth-SOPR (the short-term profit ratio) remain less than medium levels, indicating that retail speculation and aggressive profits of miners have not yet reached its peak. Jah added,

“IBCI behavior provides an important warning mark: We are in an area with highly corrective risks in the short term, but not necessarily at the top of the end of the main cycle.”

Related: Bitcoin due to “massive pressure” where BTC dominates 62 %

This article does not contain investment advice or recommendations. Each step includes investment and risk trading, and readers must conduct their own research when making a decision.