- Etherum Whale has decreased $ 295 million to buy 115,465 ETH, which is now sitting on an unreasonable loss of $ 15 million.

- If ETH remains in the range, how much time before smart money begins to exchange?

ethereum [ETH] It saw a decrease of 4.60 % on June 20, with a significant losing today with its opening of $ 2,522. More importantly, it is a villain of up to $ 2,368, which represents his lowest level during the day in nearly two weeks.

This was not just technical hiccups. It is important, ETF ETF from Blackrock (Etha) Record His first daily flow has $ 19.7 million, with a series of fixed flows for 32 days or net scratch activity.

Is this, then, indicates a shift in the dynamics of ethereum? One is not the usual flow, but more about patience that runs?

ETH holders hurt the brake

A month ago, ETH placed a sign of the lowest local level at $ 2,454. Quickly forward so far, and it hardly increases by 0.4 %, which means that the price movement is still stuck in a narrow range, and the Q2 is not completely formed until the end.

On the market, the market support levels in the market are essential to maintaining upward feelings. That is why ETH is broken less than the lowest two weeks at $ 2,368, no one has noticed.

Instead, it causes a quick reaction in all areas.

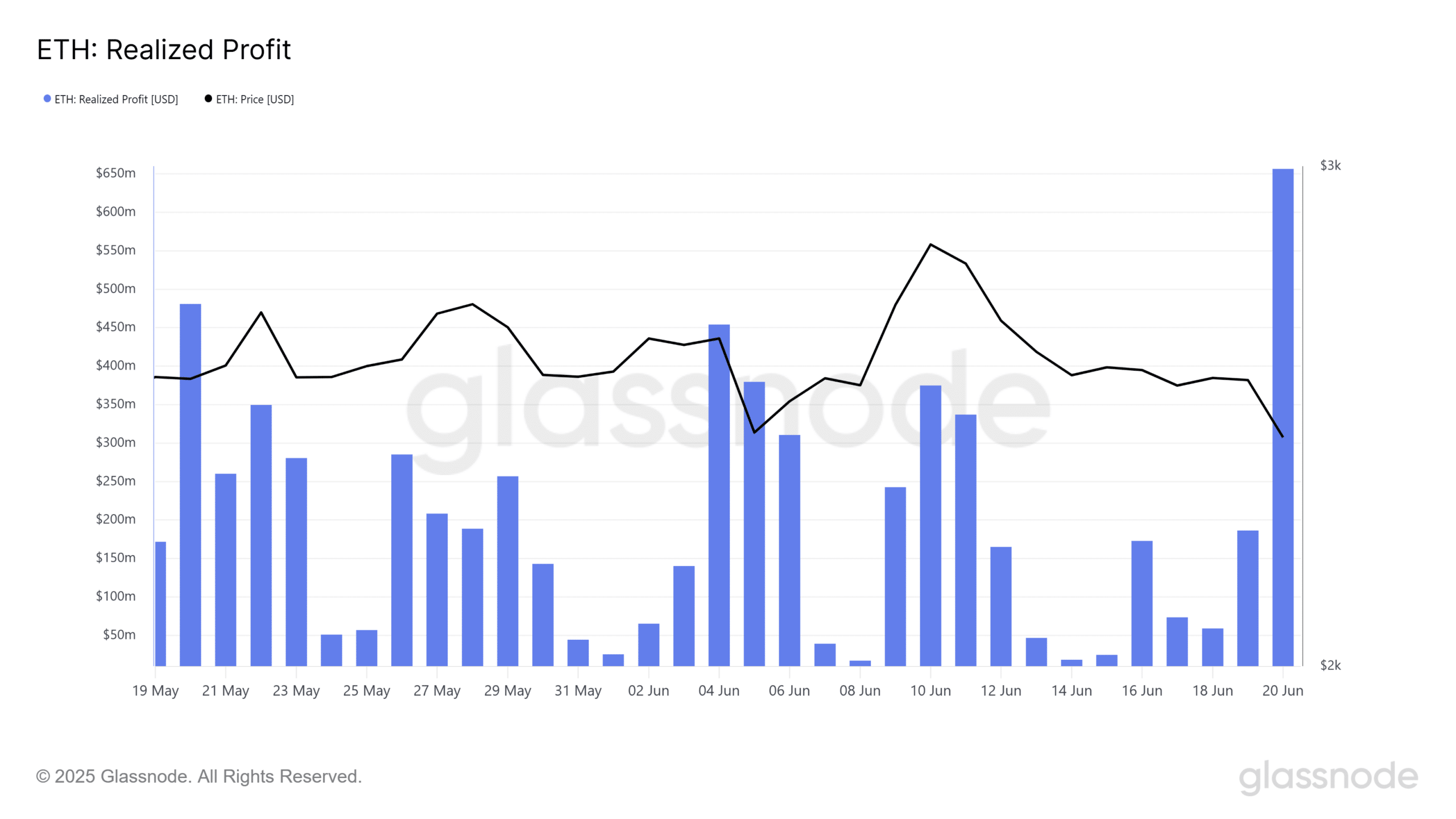

The profits achieved on the Ethereum increased to a monthly increase of $ 656 million, indicating that investors used the collapse as an exit slope. They are simply imprisoned in gains before the structure weakens more.

But not everyone hit the exit. According to Lookonchain, a whale Which has achieved more than $ 30 million on ETH in the past, just bought 30000 ETH (about $ 73 million) after the price decreased.

In fact, since June 11, this whale has spent about $ 295 million in USDC to buy 115,465 ETH at a rate of $ 2,555. Currently, about $ 15 million decreased, but it is clear that it still plays the long game.

The real question is: How long does this confidence continue?

ETHEREUM structure faces stress test

As ambcrypto maleThe last basic procedure for Ethereum has emphasized an aggressive benefit from the offer, with the benefit of survey operations that have been constantly absorbed by smart money and institutional players.

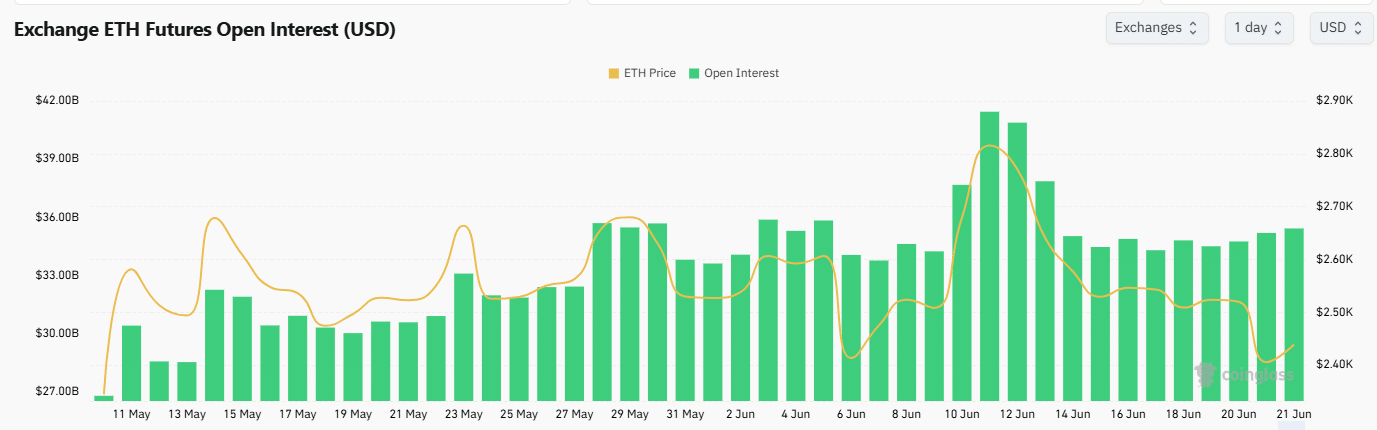

This is exactly the reason why the Blackrock flow, which costs $ 19.7 million, is important. The liquidity of the derivatives on ETH was the peak of a session of $ 41.1 billion on June 11, which means that the market was loaded with bets and risks.

Whale and ETF flows have helped absorb the initial decline, but things are now more strict. The leverage is still rising, but confidence is not. So what happens if another flow comes and no one leaves to rush to arrest the fall?

Back to the following main support area? Possible structural. As in this type of market, confidence slides and benefits from chimneys, things can quickly collapse.