In this post, I will participate two years on DePin and answer the following questions (for the indigenous people, please skip Part 1):

-

What depends?

-

Where does DePins provide a real value?

-

What is controversial in DePins?

DePin is a common word if you are a founder raising your tour … a few years ago. DePin symbolizes the decentralized physical infrastructure network. The decentralized meaning, unlike one party, the multiple parties have ownership and network (oh this Blockchand goal, right?). Materialism indicates that all service providers in the network should benefit from the material things to provide services.

DePin is a model in which users can possess and operate small pieces of critical infrastructure – such as communication networks, power networks or storage facilities – while earning bonuses or distinctive symbols to provide these services.

Filecoin is an example of DePin, let’s compare it with Google Storage:

Filecoin has storage providers who run computers, while Google has data centers. Filecoin has customers who want to buy digital storage, and Google has the same. The Filecoin protocol matches storage providers with clients, and makes sure that storage providers store customer data safely and reward storage providers for their work; Google has the data center to say “Trust me, your data is safe”, allowing you to access their data center storage and collect fees.

It can be seen that Filecoin is a non -storage version of Google storage because Filecoin does not own computers used for storage, and every service provider owns and is responsible for part of the network by contributing to storage for customers through Filecoin.

The DePin’s main value proposal is to provide cheaper or higher products through decentralization. But there is a cost of decentralization, software customers want to guide them through service. I don’t want my customer service to be uncontrictural. I think decentralization can bring an enormous value in the following applications:

-

Services that grow quality with the geographical diversity of service and density providers. An example of this is wireless and wireless communications or content delivery networks, as central entities spend billions in building a material infrastructure around the world. With DePin, these capital and practical expenses can be compensated for individuals who have a frequency range to provide such services. Helium is a great example of DePin for wireless and wireless communications. Instead of spending billions on building communications infrastructure, helium enables individuals to share their additional portable data with people around them and receive a reward. It is easy on board the plane and the fact that one can earn by selling data that they do not use more than enough to pay a geographical variety of service providers on board. As a result, the helium is able to reduce the price of mobile devices (where CAPEX and Opex are compensated for service providers, which is the cost of alternative opportunity to provide data zero).

-

Services that require expensive and rare material infrastructure to complete. Data storage and GPU are one of the most common industries that DePin can help in this regard. Data centers are complex and expensive for development and work (see Equinix, have an explosion). Thus, the data storage price and the GPU account must be enough to compensate Capex and Opex for these blocs. Filecoin and Akash are DePins that compensate for such Capex and Opex for service providers. Since they are not central to pricing these services, these protocols can be more competitive prices.

But wait …

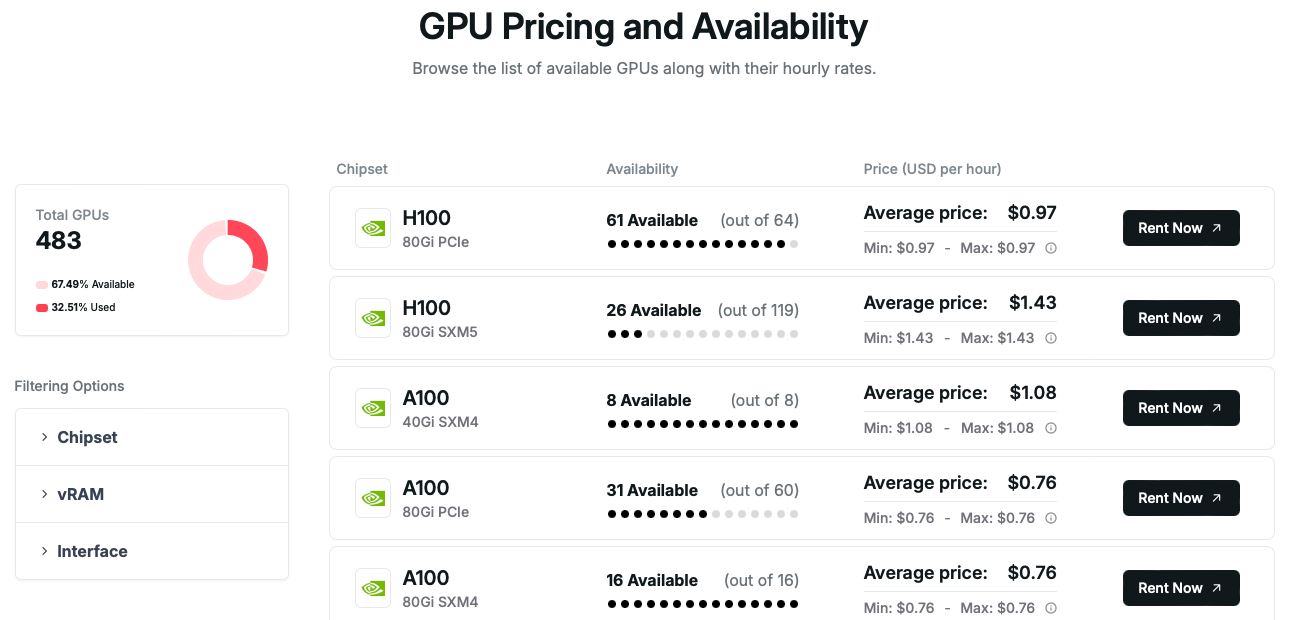

Less than half of the AKASH graphics processing units are used. There are more than the supply of graphics processing units on the decentralized GPU now, is Akash cooking? We will take a better look at it in the next section.

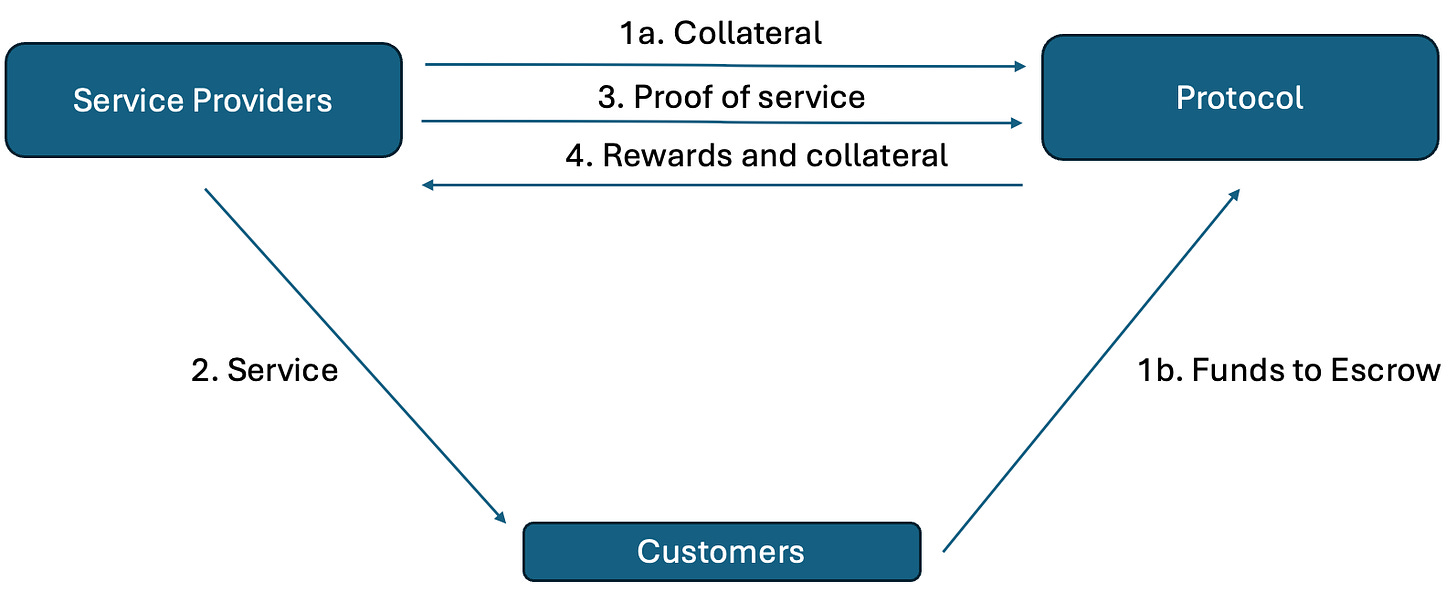

To understand what is the rest of the restaurants or common differences, we have to understand how DePin works.

-

Service providers put a certain amount of guarantee in the form of the original DePin icon before receiving a work order.

-

Customers convert the money paid to the service, usually in the form of the original DePin code, into a warranty account.

-

The service provider provides a customer service and sends evidence of providing services to the protocol.

-

When checking the completion of the service, the protocol is released from the warranty account to the service provider. If the network is not able to verify the completion of the service, the service provider guarantee will be reduced.

It is also common practices for the DePin network to delegate the service verification for service providers, and service providers who participated in this verification of “emissions” are rewarded. These emissions are the new symbols that Blockchain is raised. The amount of emissions is determined in the documents of each protocol.

In the first days of DePin, due to the lack of partnerships and marketing, there is a limited demand for its services. In order to compensate for the absence of customer fees, it is common for emissions to be more than 80 % and that fees be less than 20 % of service providers. With the maturity of the project, the demand for services increases. Thus, the projects will reduce emissions, and the increase in these fees for this income loss will be. (This is similar to the Bitcoin architecture. Half = decreased emissions, BRC20 orders have become an increased income for workers)

So with the Depin mechanics clarify, let’s dive on the common pitfalls:

-

Distinguished defective symbol

Service providers receive symbolic rewards and emissions from the network by carrying out tasks. When service providers exchange their symbols into USD to cover Capex and Opex, the symbols are pumped into the market. Consequently, service providers represent a distinctive symbol supply. Customers buy symbols to buy services from service providers, and thus these customers represent the symbolic demand.

The problem is: service providers are easier on board than customers as they are motivated by the competitive return. Unless DePin is the cheapest or better way of quality than web2 occupations, there is no way customers will turn into DePins. This leads to the offer> demand. Under the exhibition law, the distinctive symbol price decreased. In Crypto, Pearson’s connection between the project community’s participation and its price is 1, so dipping your distinctive symbol is not the exact best step.

So the next time if the founder of DePin is proud of him

\ (\ lim_ {x \ to \ infty} x \)

The number of service providers, ask if anyone consumes services on DePin. If the answer is “We have two million users who complete questions on our platforms to get points” (our users love their money until they cultivate our symbols), and this means that there is no organic request, so … shorten the distinctive code (not the investment advice).

(In a personal note: I am not a big admirer. If your product is good enough or provides real value, there will be no need for tasks because I will be essentially enthusiastic about using it).

-

Gpu undndly Sweard:

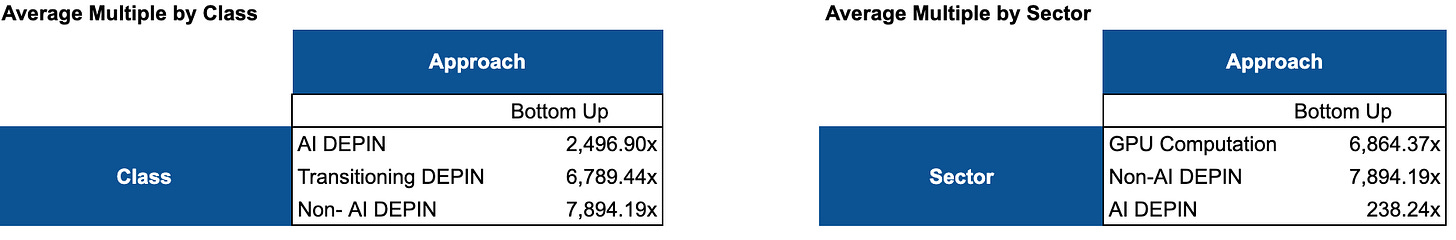

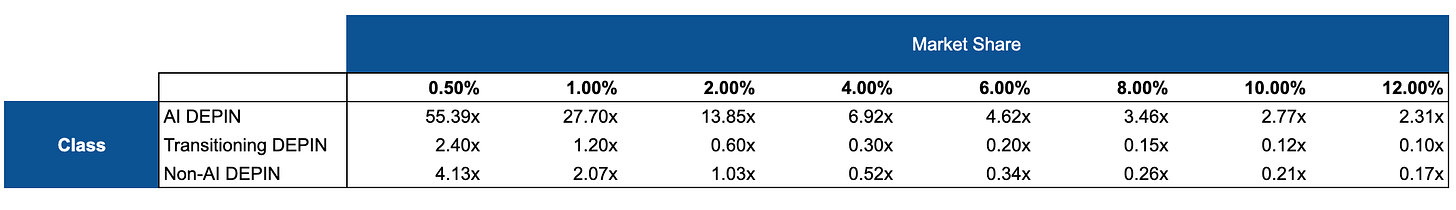

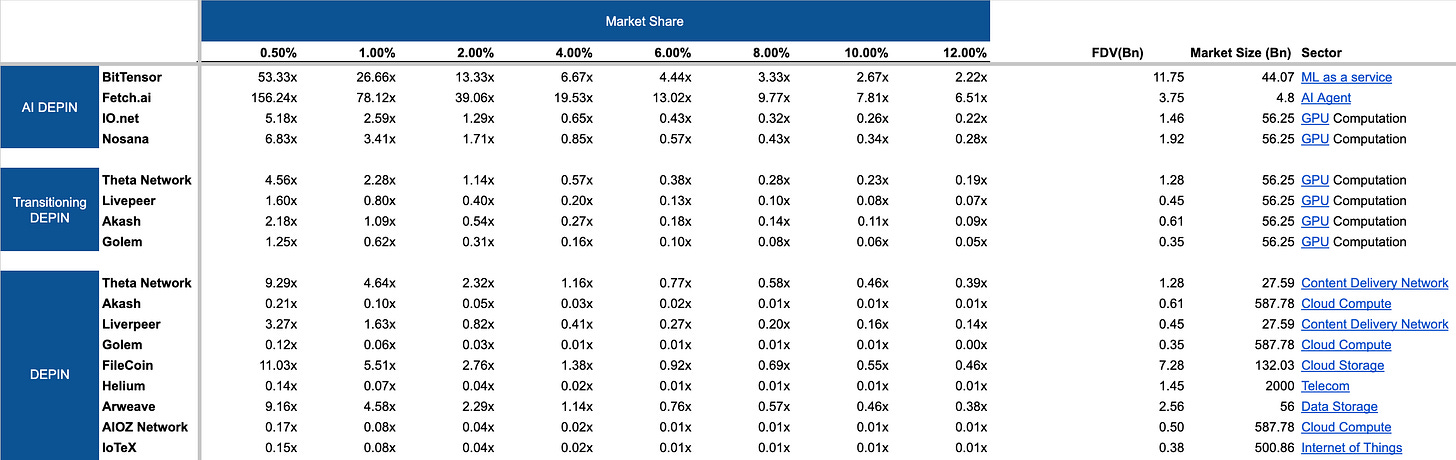

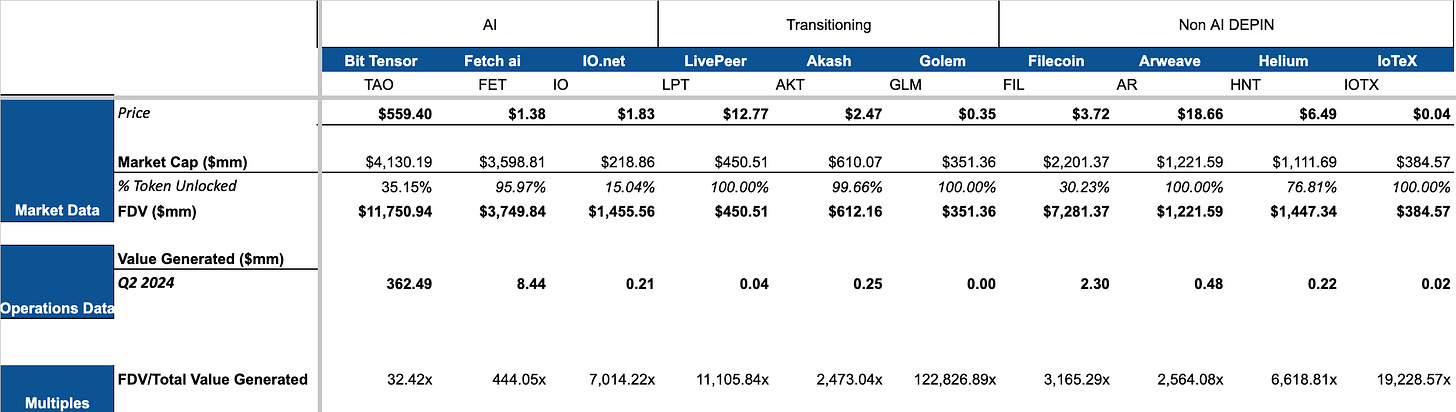

In my opinion (no investment advice), GPU symbols are exaggerated … a lot. To support my demands, I used an approach from top to top to the value of the distinctive symbols. Please refer to the appendix for the details of these methodologies, but in simple phrases, the approach takes from top to bottom the market allowance and the bottom approach is only seen to the revenues / value of the protocol created.

Ascending:

Transfer to DePins other than AI DePin that is transferred to AI DePin by listing GPU account services on its platform.

top down:

Given that the GPU account market is greater than both ML as the marketing markets of artificial intelligence agents (the size of the market is $ 56.25 billion, 44.07 billion dollars and $ 4.80 billion, respectively), GPU account projects have a higher increase than AI-original projects ( BitTensor and Fetch.AI). BTW, many high bottoms represent an increase in the high market and low -created revenues, so the market really believes GPU account projects soon. However, using an approach from top to bottom, DePin GPU projects are very conservative with the lowest complications compared to DePins AI and DePins.

This indicates that the GPU account codes are priced with the web2 market premium, however Web2’s GPU account request will not transfer Web3. It should also be noted that high complications and low profits indicate that GPU calculates exaggerated DePin projects, and therefore will not survive a narrative change. If it is assumed that most of the current order of the GPU arises from Web2, the average GPU DePin revenue of 9,701.68X is higher than the Web2 graphics unit suppliers more than 1000 times. (Current PE ratios for NVIDIA, Google (Alphabet) and Microsoft are 74.55X, 28.73x and 39.40X.) This enhances my argument as well GPU DePin projects are exaggerated compared to both GPU Web2 and other artificial intelligence factors.

A few months ago, there was a debate About how physical should be DePin. The arguments are as follows:

The less Adays, the easier it is to expand its scope and verify (all programs). The more material material, the more CAPEX and Opex. The high costs create an entry barrier and pay towards centralization (for players who have capital to build the required physical infrastructure).

The less physical network, the easier it is to repeat the network (only the symbol of the open source symbol, right? :)). The customer retaining rate will be less, which leads to price wars. Moreover, the problem that DePin tries to solve is to lower Capex for physical infrastructure, and the more physical service, the more DePin helps it.

Everyone in all, I am a big admirer, Arrington Capital Dib deal I am a source. But my year is:

-

DePin is cooked when the number of service providers is largely larger than customer customers. This is usually the result of an excessive incentive program (unsustainable emissions) for service providers.

-

GPU’s estimated codes are exaggerated at the present time because the lack of the advertised graphics processing unit is often correcting itself.

-

DePins may expand with less physical overseeing than those that require costly costly supervision, but it is easy to repeat and decrease customer retention.

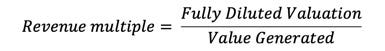

I followed the approach in the article “Discovery of Taoism: a trip to bittensorThis model determines that the project’s experimental evaluation is the target market size of the project in the project’s market share. Then the number of times the FDV is calculated greater than its experimental evaluation.

*It should be noted that although I use the current (unexpected) market size, the installment may have already been priced in the current market.

The bottom model follows the formula below.

The definition of the value generated for each protocol is different as shown below:

The value generated

-

Asking

BitTensor is born 372.29 mm USD through emissions in Q2 2024. (372.29 mm is calculated by Tao Price * 7200 Tao emitted per day * 90 days per quarter.

-

Fetch.ai

Fetch.ai is born Fet earning it Staking (9.61 % APY, 351.49mm USD Stapked) + Fet earned it to create and host artificial intelligence agents

-

i.net

Money in workers’ guarantee today + network profits today + network profits during the past two weeks) * 2 * 3 = 34,586 * 2 * 3 = 207,516 USD

-

Make

(73,952-39,558) RNDR codes in Q2 2024 * RNDR Price

-

Livepeer

Fees spent on the platform ($ 40,565 in the first quarter of 2024, $ 60.050 in Q2 2024)

-

Akash

The total USA ($ 247,532 in Q2 2024)

-

Julim

Network profits (678.92 GLM after 7 days * 12 weeks * GLM price)

-

Felicoin

618,382Fil * Fil price = 2.59mm USD

-

Arrow

Consumer fees: stored data * storage cost + transaction fees = 16,179.2gib * 0.75ar * AR + 13,429.83ar * AR price. (15.8TIB downloaded on Q2 2024)

-

Helium

Use the network in US dollar (30 days) * 3 = 72,890 * 3 = 218,671 USD

-

IOTX

Gas fees (q1 2024, gas fees on iotexscan cannot be found = 20,000 USD