The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Football price for lion and players soft. All Arcu Lorem, Intrimies, any children or, ulamcorper, hate football.

Solana is trading at a critical level where the broader encryption market enhances less than the main resistance areas. After a 90 % impressive increase since early April, Sol has witnessed a modest decline, which raised speculation that this might be the final decrease before a significant transition. While many assets are struggling to maintain momentum, Solana has shown remarkable strength and elasticity, which enhances upscale expectations.

Related reading

Cas ABBE analysts shared an artistic view indicating that the long -term bullish structure of Solana is still firmly sound. According to ABBE, last month re -test of the multi -year trend line represented a pivotal moment of assets, enhancing support and morale reset for a possible continuation. Since the reversal of this level, Seoul has continued to rise steadily, and many now believe that Solana is preparing for another leg.

With the improvement of the basics and historical patterns that indicate the renewed trend, the market is closely monitoring. A successful restoration of the levels of nearby resistance can be the trigger that drives Solana to return to its highest previous levels ever-outside. At the present time, Sol holders are looking for this The monotheism stage As calm before the storm.

Solana carries cash support with the continuation of Market Eyes Bullish

Solana is testing a decisive demand area around the level of $ 165, in an attempt to create a basis for its next main movement. This range has become a major battlefield between bulls and bears, especially since the broader market morale is formed through Bitcoin’s struggle to overcome its highest level ever. As BTC stops slightly less than $ 109,000, uncertainty withdraws expectations for many altcoins, including Sol. However, Solana continues to show signs of relative strength.

Despite the recent decline, the total trend of Solana is still optimistic. According to AbiThe bullish trend is still intact. Last month, Solana succeeded in storing the long -term trend line, which ABBE believes the bottom of the last correction. Since this apostasy, the Seoul has risen more than 50 %, indicating the strong investor confidence and strong basic momentum.

ABBE emphasizes that the amount of $ 290 which was seen earlier was not the final peak of Solana, as it offered a new rise at some point in 2025. It supports its upscale thesis by improving the basics via the Solana ecosystem, including the increasing activity of developers, increasing the participation of Defi, and increasing the use of the chain.

Related reading

Sol price analysis: Line holding before a big step

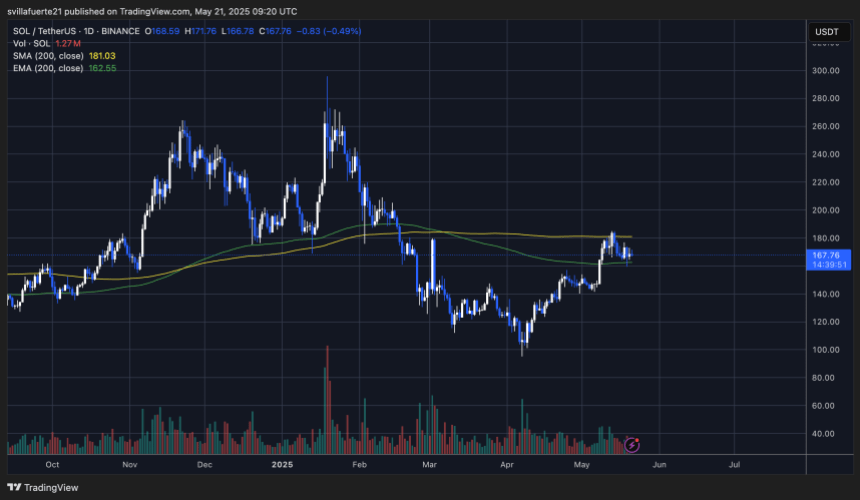

Solana (SOL) is currently trading at $ 167.76 after a sharp gathering in early May, which prompted the price over both EMA for 200 days and 200 days SMA. The graph shows that Sol climbing more than 90 % since its lowest level in April, confirming the bullish momentum and renewed interest in the market. However, the price is now just lower than SMA for 200 days at $ 181.03, which works as a dynamic resistance.

The main support near EMA lies for 200 days at 162.55 dollars. As long as Sol holds this level, the short -term structure remains upward. A clean break above the level of $ 181 will open the door to a move towards the brand of $ 200 and possibly higher. But if the bears regain control and the separation of prices to less than $ 160, the upward trend may be in danger.

Related reading

The volume has decreased slightly since it may penetrate the early, hinting to a possible exhaustion or unification before another leg. Traders closely monitor the confirmation – either the outbreak of $ 181 or a collapse below EMA.

Distinctive image from Dall-E, the tradingView graph