Key takeaways

Why did Solana fall after Forward’s move?

Move forward by 1.727 million soles while holding losses on a position of 6.83 million soles.

What’s Supporting SOL’s Recovery Now?

Whale buying, rising active addresses and demand near $130 boost the prospects for a near-term recovery.

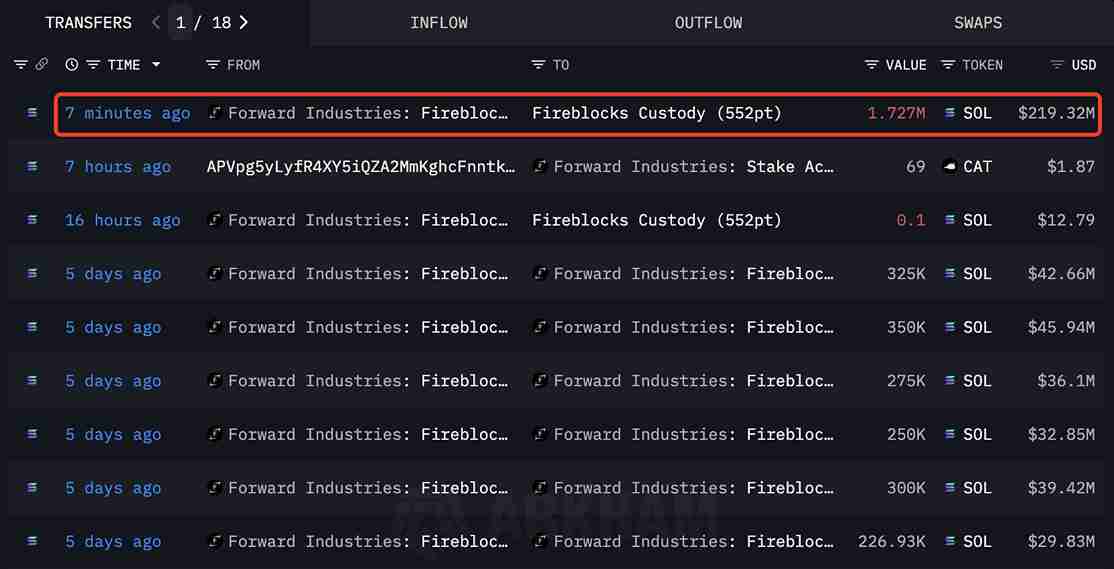

Forward Industries transferred 1.727 million SOL worth $219.32 million to wallet 552ptg, According to To Leconchine. The move ranks among Solana’s biggest moves of the quarter.

Arkham data showed that the company raised $6.834 million Solana [SOL] For $868 million, with an average income of $232.08. The position had an unrealized loss of 45%, leaving approximately $718 million underwater at the time of the transfer.

However, Forward Industries still owns approximately 5 million Sol. This residual volume suggests long-term biased position taking, even as sentiment around Solana turns highly reactive to institutional flows.

Institutions withdrew as the whales increased in size

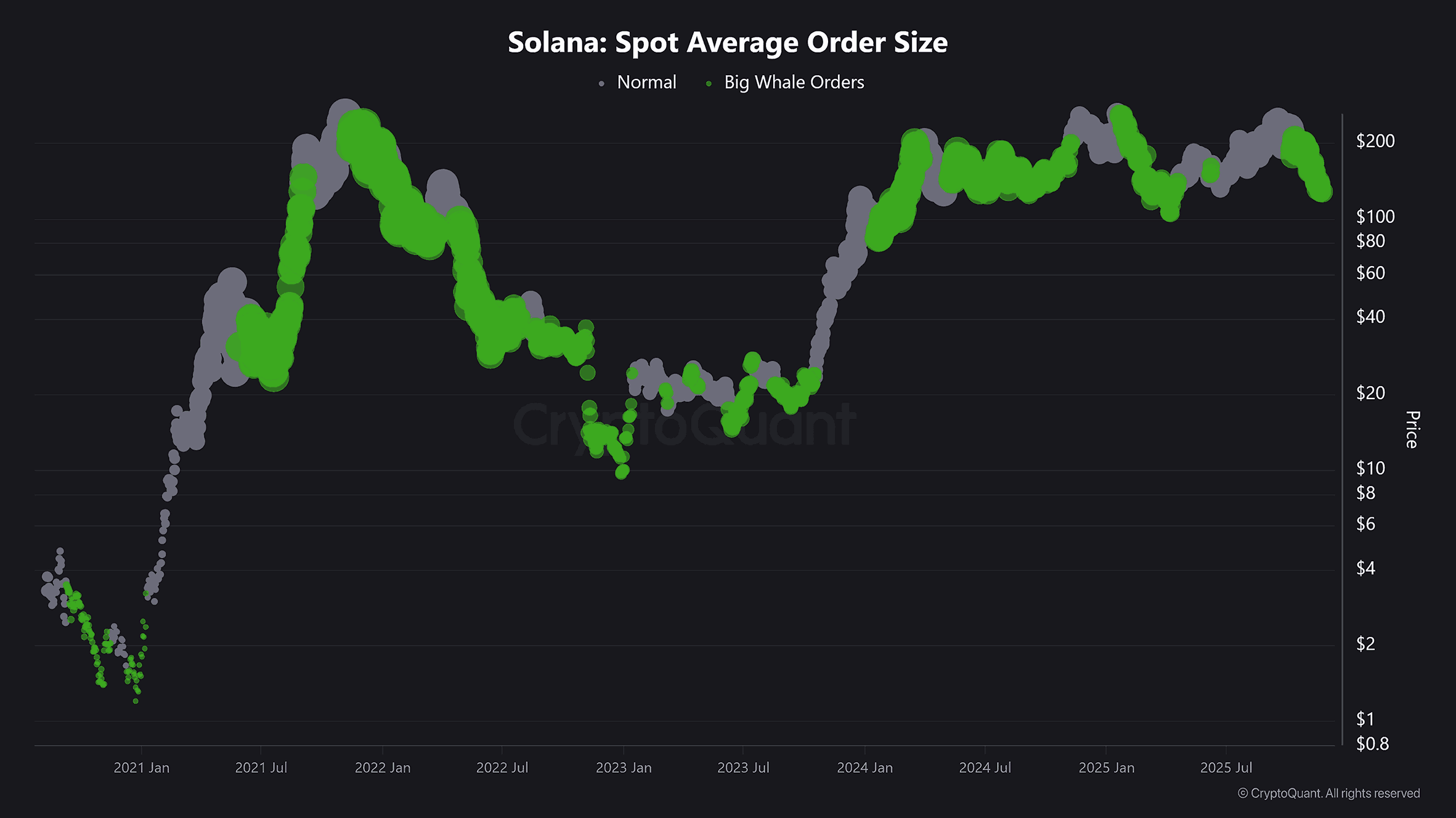

Solana’s whales moved strongly during the same window. In contrast, large spot buyers continued to accumulate, even as institutional flows weakened.

CryptoQuant’s average spot order volume showed an acceleration in large ticket purchases near current prices. This consensus revealed a continuing interest in whales despite Solana’s broader withdrawal.

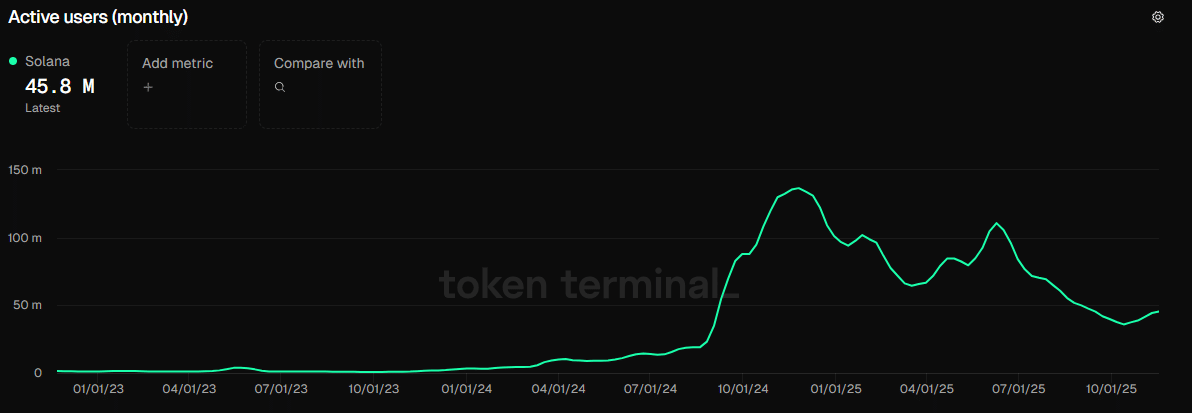

Furthermore, Solana’s monthly active addresses rose to 45.8 million, up 21% from last month. The recovery has been fueled by continued use of the network, giving traders a counterweight to institutional selling.

The key level remains steady as traders watch for a recovery to occur

Solana rebounded from a key daily demand area near $130, creating short-term stability. This area has mitigated the recent selling and kept the downward pressure under control.

Having said that, Solana still faces pressure from the top. The next target is near $170, which is the immediate resistance shown on the chart.

This level represents the previous breakdown structure and is in line with the failed retests in early November. A break above $170 could shift momentum towards the $190-210 range, where supply remains heavier.