The interactive force loses money on its sales of high -end and organic fitness equipment. It turns into the latest innovation of Crypto to reflect its wealth.

TRNR is going on everything on the encryption icon

(The image created from artificial intelligence)

Posted 11 June 2025 at 10:00 pm EST.

With the increasingly direction of the Bitcoin Treasury, a new strategy for companies appears: money allocating to the platoking.

The latest company to join this movement is interactive stregth Inc. (NASDAQ: TRNR), which is a company manufacturer in Austin, Texas. This morning, the company Declare According to her press release, “A $ 500 million facility to acquire the distinctive symbols of $ Fet focuses on AI, according to its press statement. Funding comes from ATW Partners and Crypto Market Maker Labs.

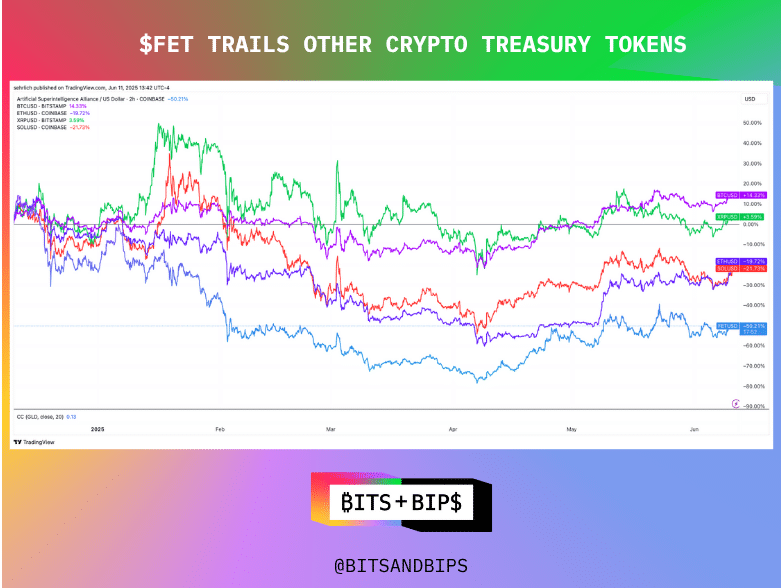

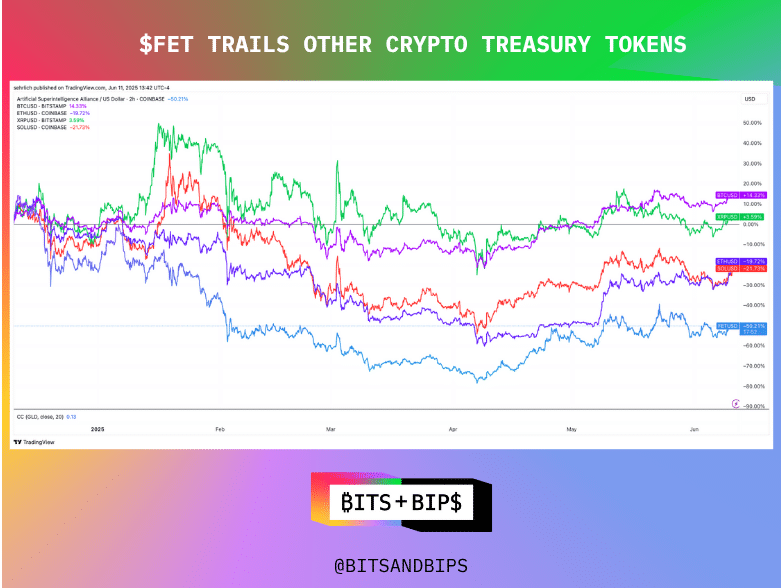

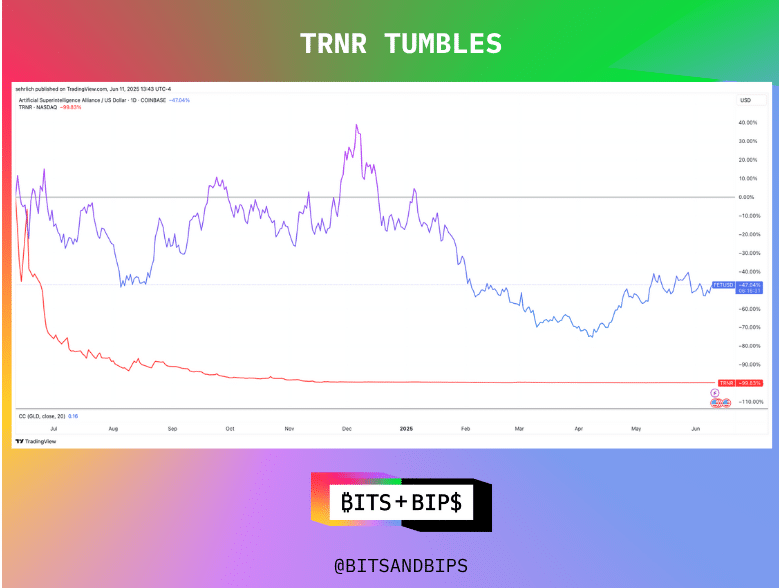

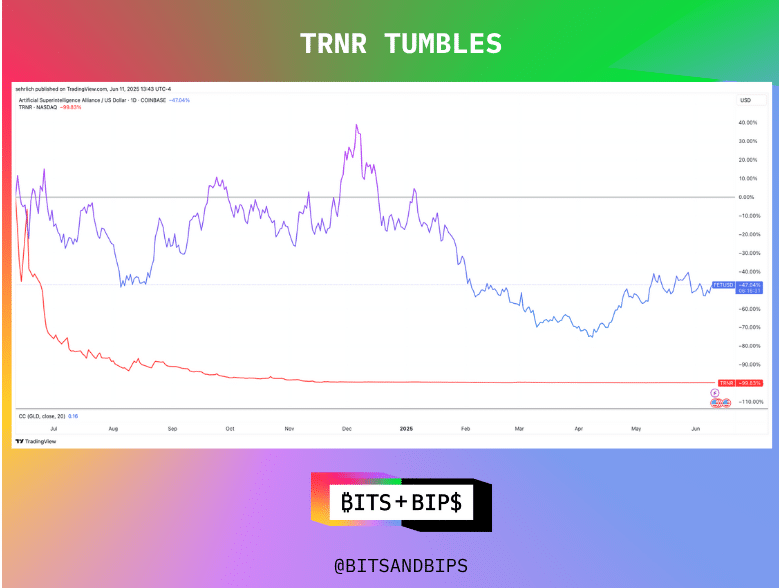

Fetch.AI (Fet) is the original symbol of the artificial Superntelligence Alliance, which is a Blockchain network of artificial intelligence agents that place itself as a competitor to platforms such as ChatGPT, anthropology, and yoz. Despite her ambitions, FET has recently struggled-has decreased 50 % over the past six months, making it a worst performance symbol among those adopted to use the cabinet for companies.

One of the industry analysts, he speaks on the condition of anonymity, compare FET with another controversial symbol. “Fet is XRP of decentralized artificial intelligence, meaning that it has been closed on Mimi from AI advanced. Perhaps not successful like XRP with narration of” the future of financing “, but the effect of the MG is real. It contains some capital and a few job projects associated with an account-but in the end, there is not much in terms of essence.”

Moreover, the number of $ 500 million in the declaration of interactive power is also a little smoke and mirrors.

Interactive

In this announcement, the CEO of Trent Ward interactive company said, “As a global pioneer in encryption and market making investments, we see tremendous potential in TRNR and vision of fetch. , This indicates the next wave of capital markets for companies that adopt the digital assets driven by artificial intelligence. “In additional marketing materials on its website, the company indicates that it sees a synergy between its well -being and AI.”Unlike traditional artificial intelligence models that create only content, these factors are designed to work in the real world-allocate exercises, maintain maintenance, improve data flow, and even enable incentives based on the distinctive symbol of the most healthy behavior, ” Read.

This optimism will need to be paid. The interactive force shares decreased by 71.10 % over the past six months and 99.82 % during the past year.

According to Annual hadith The report was submitted to SEC, and the company recorded a net loss of $ 34.9 million in 2024 and has only $ 3.9 million revenues. However, this was an improvement in her performance in 2023, when she produced a loss of $ 51.3 million and achieved revenues of only $ 574,000. The company is proud of a brighter future for its business, outside the new Crypto Treasury strategy, based on two acquisitions that are expected to be closed in 2025. An updated offer for the investor from MayShe claims to be on the right path for $ 75 million revenue, and that she will be profitable by the fourth quarter of this year.

$ 500 million – or just an illusion?

This unstable financial situation is likely to be that the interactive force waives some of its agents, or autonomy, in this last deal. It appears to be the first to arrange a coded treasury, the company agreed to a item Allowing each of the investors to “demand borrowers to make additional, convertible, capable notable, up to an additional 4444444445 additional dollar.” The strike price will come for each transfer by 20 % to the official Nasdak closing the day before the memorandum closed.

In practical terms, this means that the $ 500 million deal is actually an investment of 55555555 USD, as it was designed of $ 444 million as an optional extension-and not to pump guaranteed capital.

Although this is not necessarily a negative deal for the company – after all, it is likely that the investors can only practice item if the Crypto Treasury strategy works – it appears to be a great reflection of the dynamics of unbalanced strength between different entities. “We welcome our continuous investment strategy to invest the capital by 20 % in the market, and to support our vision to acquire the distinctive symbols of $ Fet,” Trent Ward, CEO of Interactive Strongth by e -mail. “We are open to more convertible debt version when they create value for shareholders and feed our growth.”

In fact, it is difficult to look at deals such as these and not remind the direction during the era of the first currency of the currency (ICO), when it became also common for companies to add the word “Blockchain” to their name. The most famous example is the Long Blockchain Corp, whose shares rose by 380 % in 2017 after changing its name from the Long Island Ited Tea Company. The stock was in the end to cross out From Nasdak in 2022, none of them has never achieved The so -called Blockchain’s aspirations.

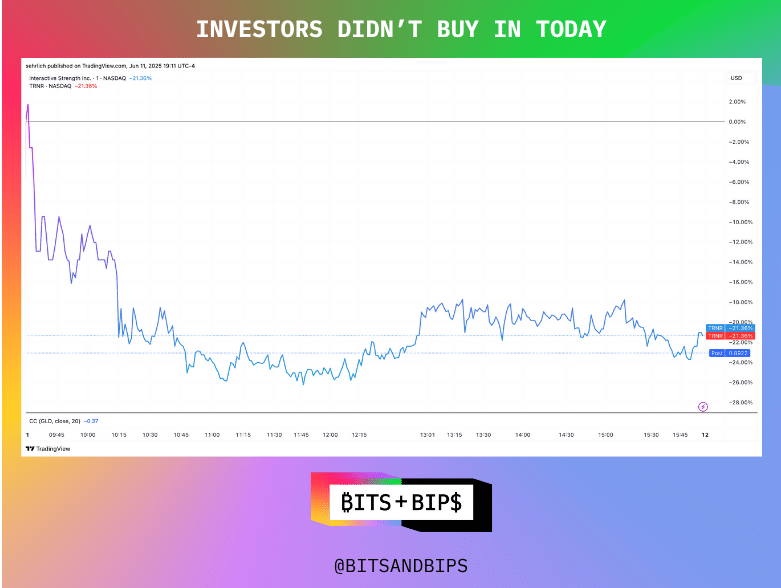

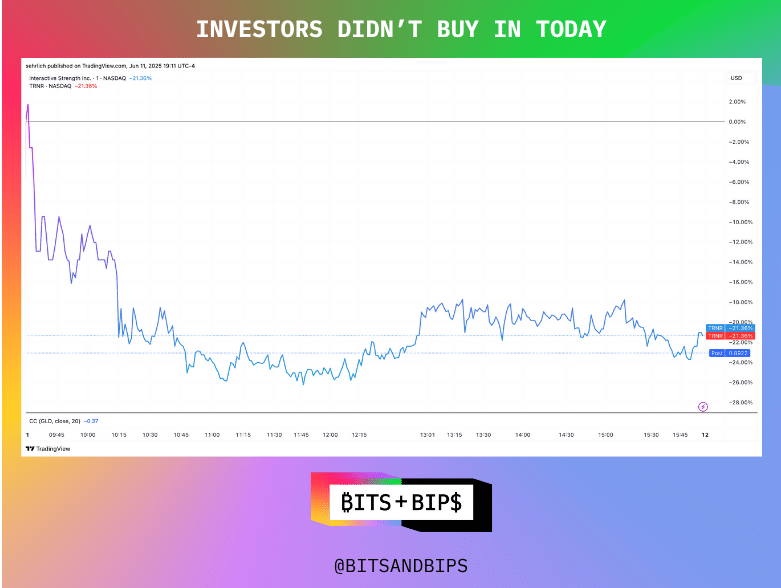

The interactive force ended today with a decrease of 21 %.