TL; Dr

- Bitmex has constantly pushed positive financing rates on Enausdt, in contrast to Binance and other fixed financing rates for CEX.

- A short site pair with Pende’s PT Sena Tokens is a neutral return in the market exceeding 20 % APY.

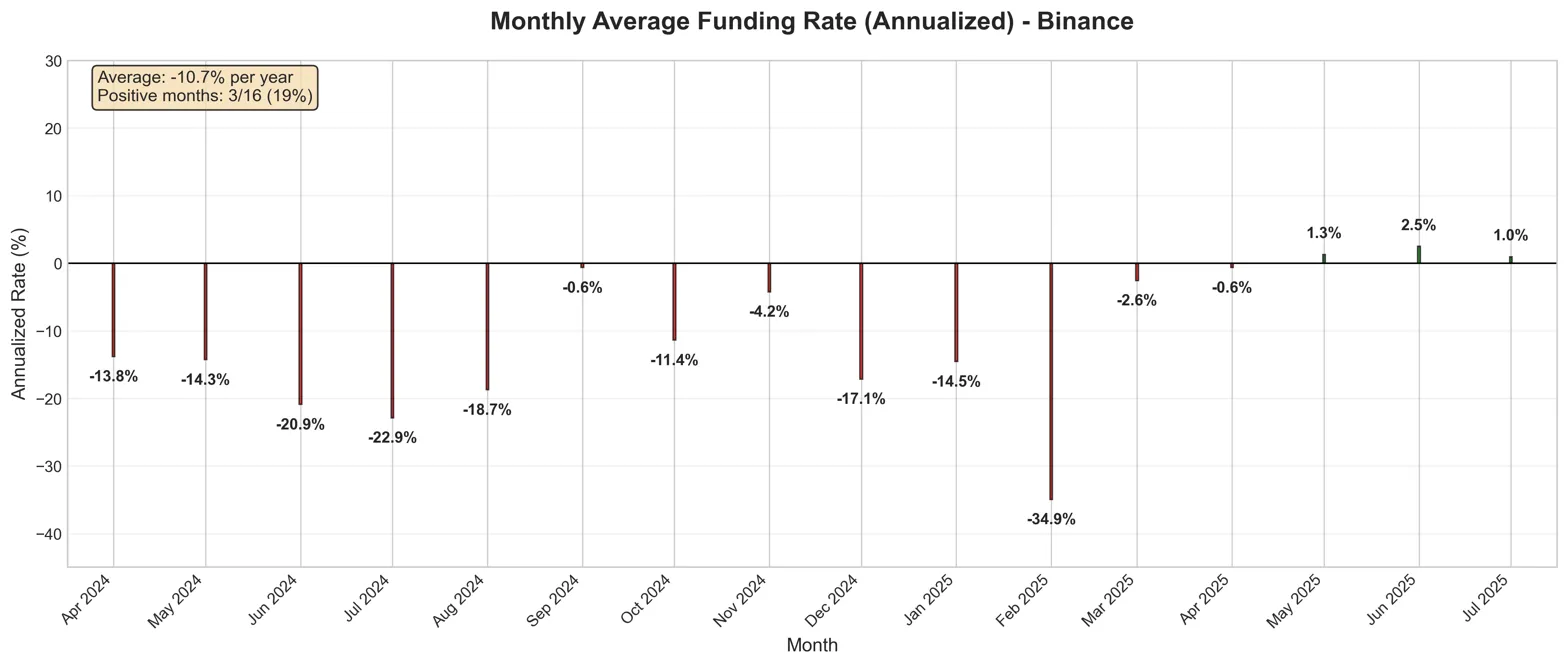

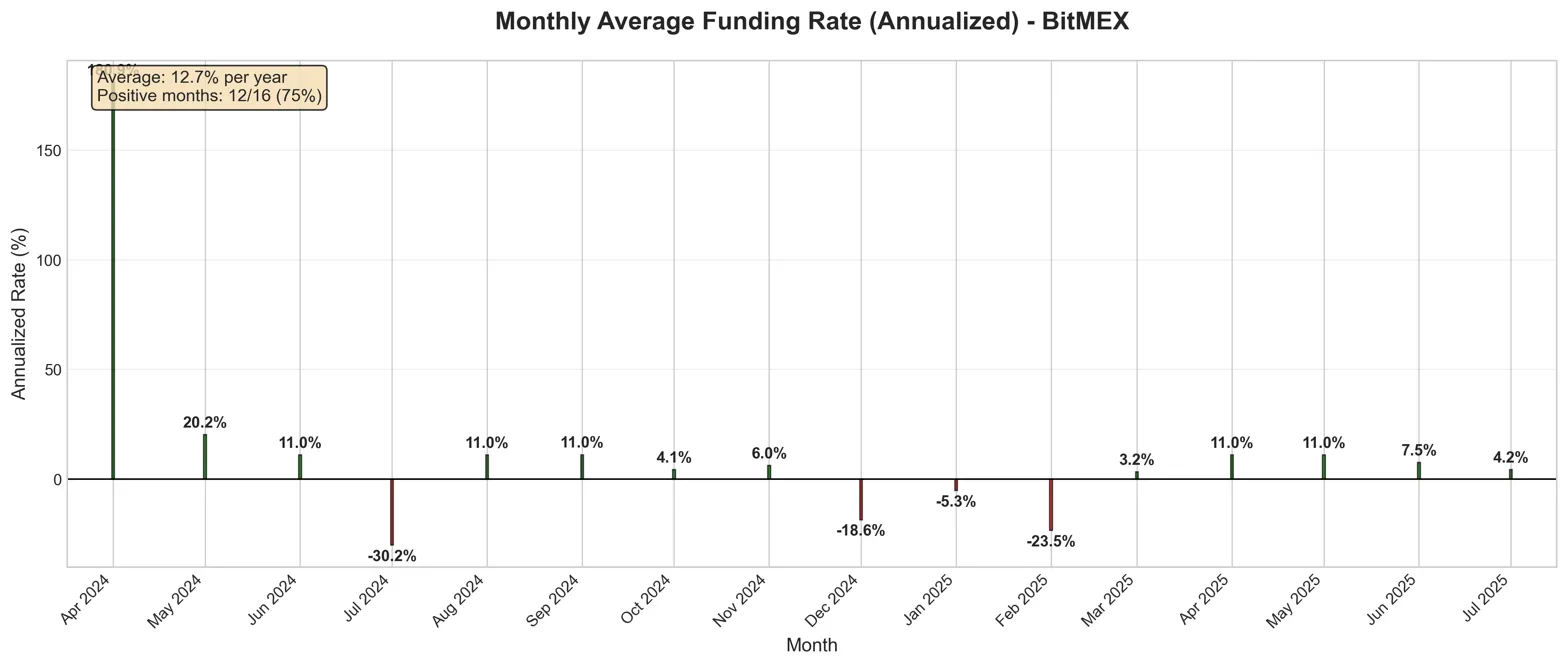

- Enausdt funding from Bitmex has been positive 75 % of historical months compared to only 19 % on Binance, supports the stability of this strategy.

The strategy clarified

The strategy clarified

The strategy takes advantage of the Bitmex Structural Funding and the PENDLE FINANCE’s PT SENA.

The strategy takes advantage of the Bitmex Structural Funding and the PENDLE FINANCE’s PT SENA.

PT SENA’s distinctive symbols are the main component of Staped Ena (SENA). Pendle is divided into a symbol of return into symbols (YT) and the main symbols (PT). PT SENA’s distinctive symbols provide investors with a fixed return (currently 27 % APY) by locking in future Airdrop bonuses at a low price of a reduced submitted (September 25, 2025). Basically, Pendle enables pleasure traders to sell reduced future revenues, providing stable and stable returns independent of market changes.

By combining these two supplementary sources of income-fixed revenue in Pendle and the positive financing of Bitmex- You can achieve great stable and neutral returns higher than the typical market yield.

Financing scene: Bitmex feature

We analyzed Enausdt financing rates via the main stock exchanges from April 2024 to July 2025. The results reveal a remarkable difference in view:

Data tells a clear story. BitMex merchants remain upward in Ena, which constantly pushes positive funding to maintain long jobs. Meanwhile, Binance has become a haven for farmers and professionals, prompting deep negative financing. This continuous spread creates our arbitration opportunity.

Smitation of the strategy

1. Buy ena (spot)

Get $ Ena on any favorite exchange, and create exposure to basic assets. You can pull the usdt to Mainnet ethereum and buy via Cowswap

2. Hessing and Annat symbols

- $ Ena symbols through Ethina earned To receive Sina

- Deposit Sena in Pendle Finance, Manufacturing PT SENA codes that close the 27 % APY fixed return (September 25, 2025). You can do this here.

3.

Always open a position on Enausdt Prepaal at the point of the risk of hedging prices and capturing a positive financing rate constantly on Bitmex enausdt.

Profit estimate:

Let’s go through a concrete example of $ 100,000 capital:

The components of the return:

- Expected financing for bitmex: 11 % x 60,000 dollars = 6,600 dollars annually (assuming an initial margin of $ 40,000, a crane of 1.5X)

- Pendle Pt Seena return: 27 % x 60,000 dollars = 16200 dollars annually

- Total Total: 22,800 dollars (22.8 % APY)

With a 1.5X crane, keep the short bitmex site, you can get clear returns more than 20 % APY for two months coming until the expiration of PT Ena.

Useful tips

Entry sequence:

- Check the BitMEX financing rate is positive

- Buy the Ena spot

- Immediately shorten a virtual amount equivalent to Enausdt’s bitmex

- Ena class in favor of SENA on ethena

- Deposit SENA to Pendle and Mint Pt codes

Power management:

- Monitor the daily financing rates (bitmex updates every 8 hours)

- Maintaining excess margin by 50 % for weather fluctuations

Exit strategy:

- Close your Bitmex image during low periods

- Selling codes on Pendle or sticking to maturity

- Check Cena (Note: 7 days waiting period)

Risk considerations

There is no strategy without risks. This is what to see:

The risk of liquidation Even with hedge situations, each leg has a liquidation price. A sudden rise can liquidate the short before you can add margin. The solution: Use the modest financial lever (a maximum 2-3X) and keep the temporary warehouses the generous margin.

Change the financing system If BitMex financing turns negatively, you will pay instead of receiving it. Watch daily and be ready to relax if the system turns.

The risk of smart nodes Both Ethena and Pendle involve the risks of smart nodes. While both protocols are checked, insects or their exploits remain possible. Size sites accordingly.

Liquidity restrictions The 7 -day Sina period means that you cannot come out immediately. The position plan is in mind.

Why are a point picture?

This strategy offers a unique bitmex as a better place to hedge:

- Continuous financing installments

- A reliable infrastructure With no time to breakdown during financing accounts

- Flexible multi -asset guarantees To compete with the margin

The bottom line

Bitmex-PENDLE ENA provides something rare in encryption: arrow-like returns with bond-like risk. By combining the structural financing of Bitmex with the guaranteed return of PENDLE, merchants can harvest more than 20 % of APY without bearing the risk of direction.

Data talks about itself. Bitmex pays, while others do not. Add Pendle’s return, survival neutral, and collect your return. Sometimes the best deals are simple.