Main meals

The last gathering of Virtual was reflected, as the bears regained control as investors from space and derivatives collectively. Funding rates decreased through top stock exchanges, while the size and liquidity moved away from the original.

the The virtual protocol [VIRTUAL] One of the most severe declines in the past 24 hours has been recorded, Flows out of liquidity are paid from stock exchanges with a decrease in the price of 12 %, at the time of the press.

This is placed from the worst performance in the market, a decrease of 28 %, according to the Altcoin season index.

The continued sale in both derivatives and instant markets can exert more downward pressure on the original, which increases losses. Ampcrypto examines the factors that lead this trend.

External flow pressure for investors

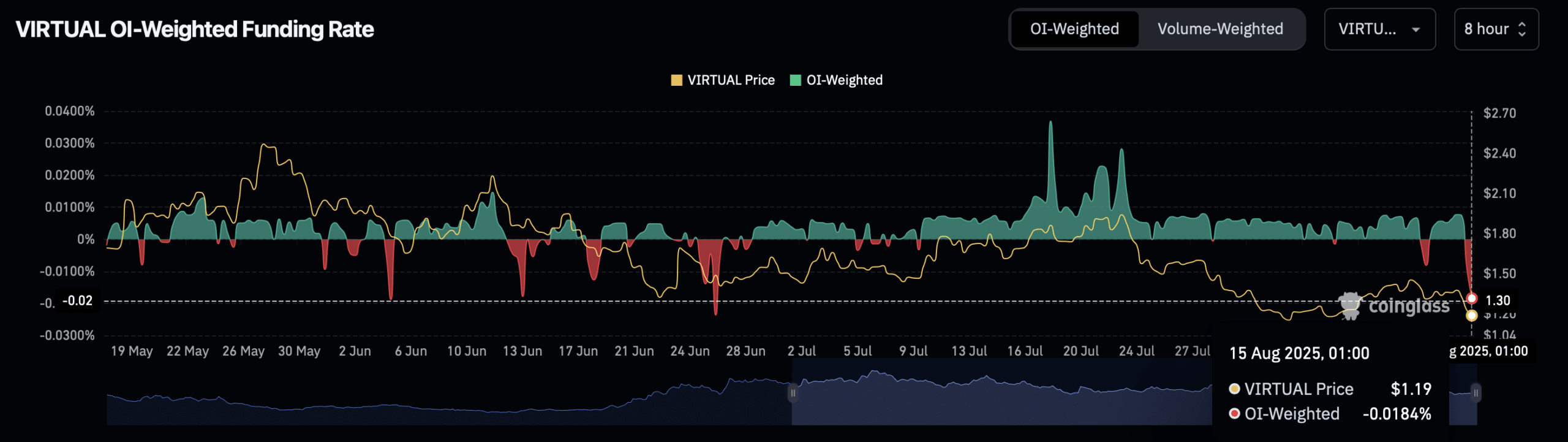

The morale of the derived market has turned into a complete landing, while stirring the weighted financing rate to negativity.

At the time of writing this report, the scale -0.0184 % reached, which confirms that the declining situations now dominate the open contracts. This is the least reading since late June, when Al -Dhahiri also suffered from a sharp drop in prices.

In addition to negative morale, the weighted volume -based financing rate also transformed into a negative, which reflects the weakness of the bullish momentum as the bears boost their grip.

Currently, derivative data indicates that investors do not see minimal capabilities to attend prices, while proving more profitable positioning.

The immediate market adds to the pressure pressure

During the past 48 hours, the investors of the immediate market added to the sale, where nearly one million dollars were recorded in external flows.

This trend indicates that merchants now prefer to keep other virtual commercial husbands they consider to be more profitable in the long run.

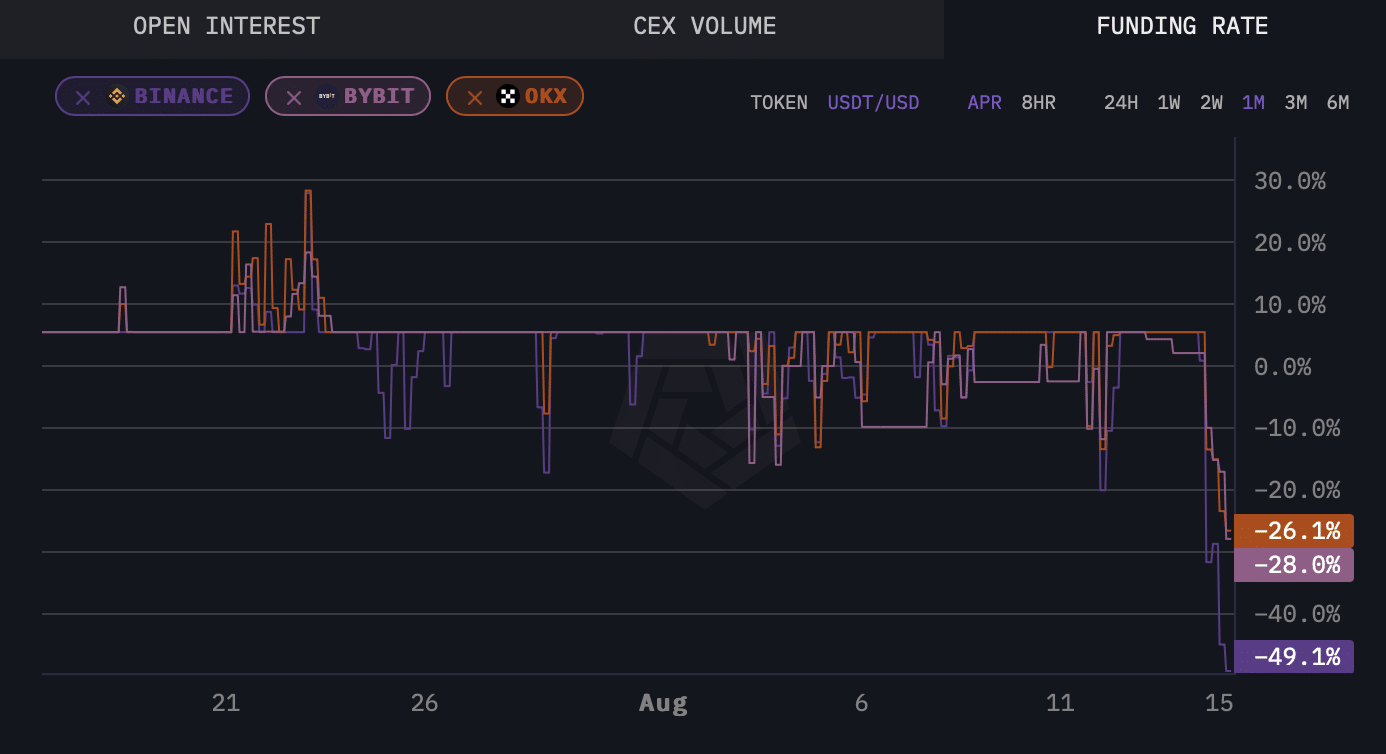

The financing rate data showed that the remaining liquidity on the stock exchanges is perverted towards low prices.

Arkham intelligence It was reported that the first three centers – the brand, bybit, and OKX – have seen that their financing rates decrease to 49.1 %, 28.0 % and 26.1 %, respectively, as of writing this limit.

The ongoing external flow in this direction would make the recovery of prices increasingly unlikely.

Virtual price expectations

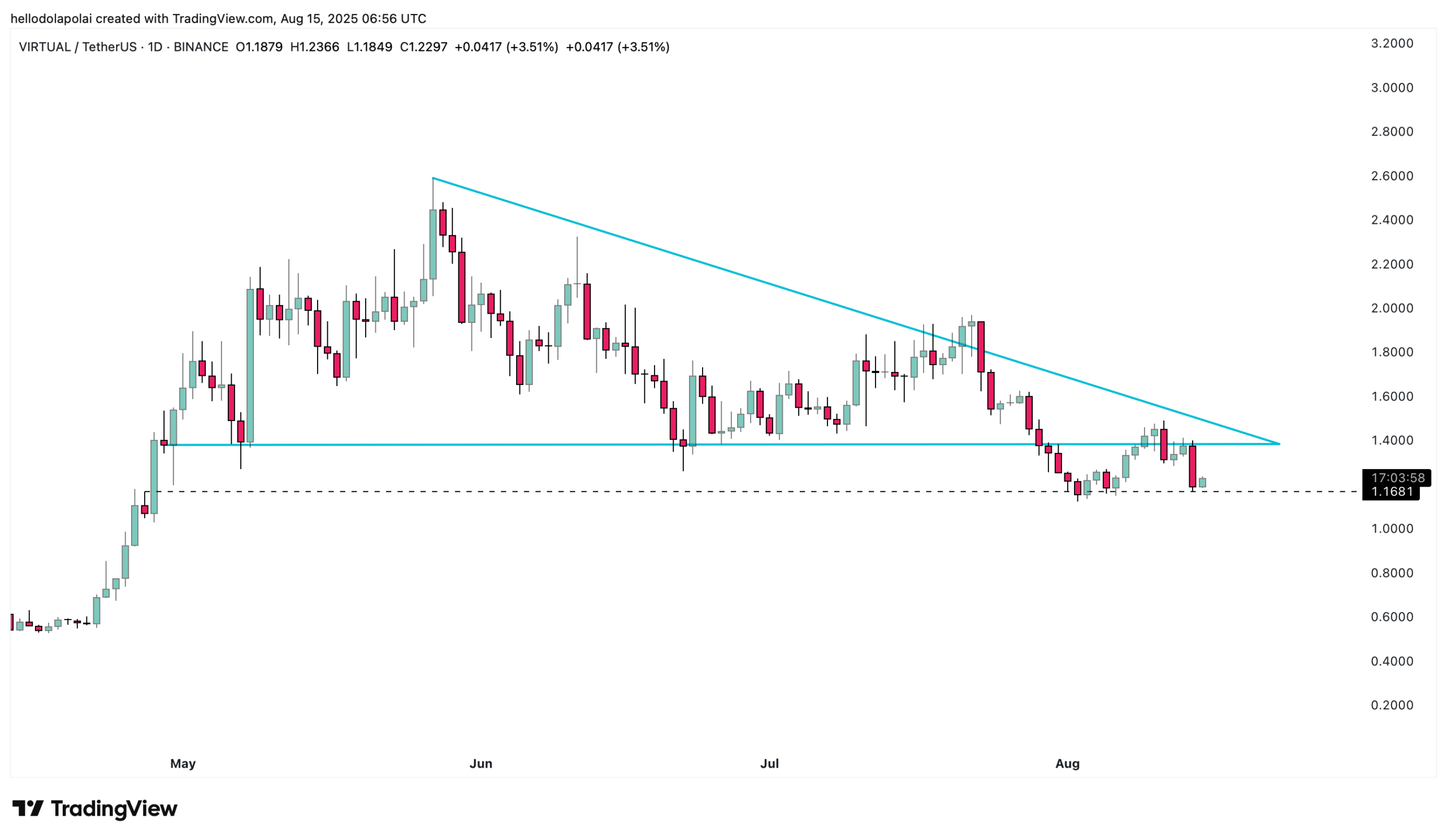

The feelings of Virtual’s Chart seemed neutral, at the time of the press.

The last decrease followed a failed attempt to restore the bullish triangle style, which prompted the price to the main support level at $ 1.16.

A bullish issue can appear if the assets are committed of this support and restore its lost bullish structure.

However, the rest that is less than this support is likely to lead to another declining tour, with the possibility of a deeper decline as there is no important support to expand more losses.