Main meals

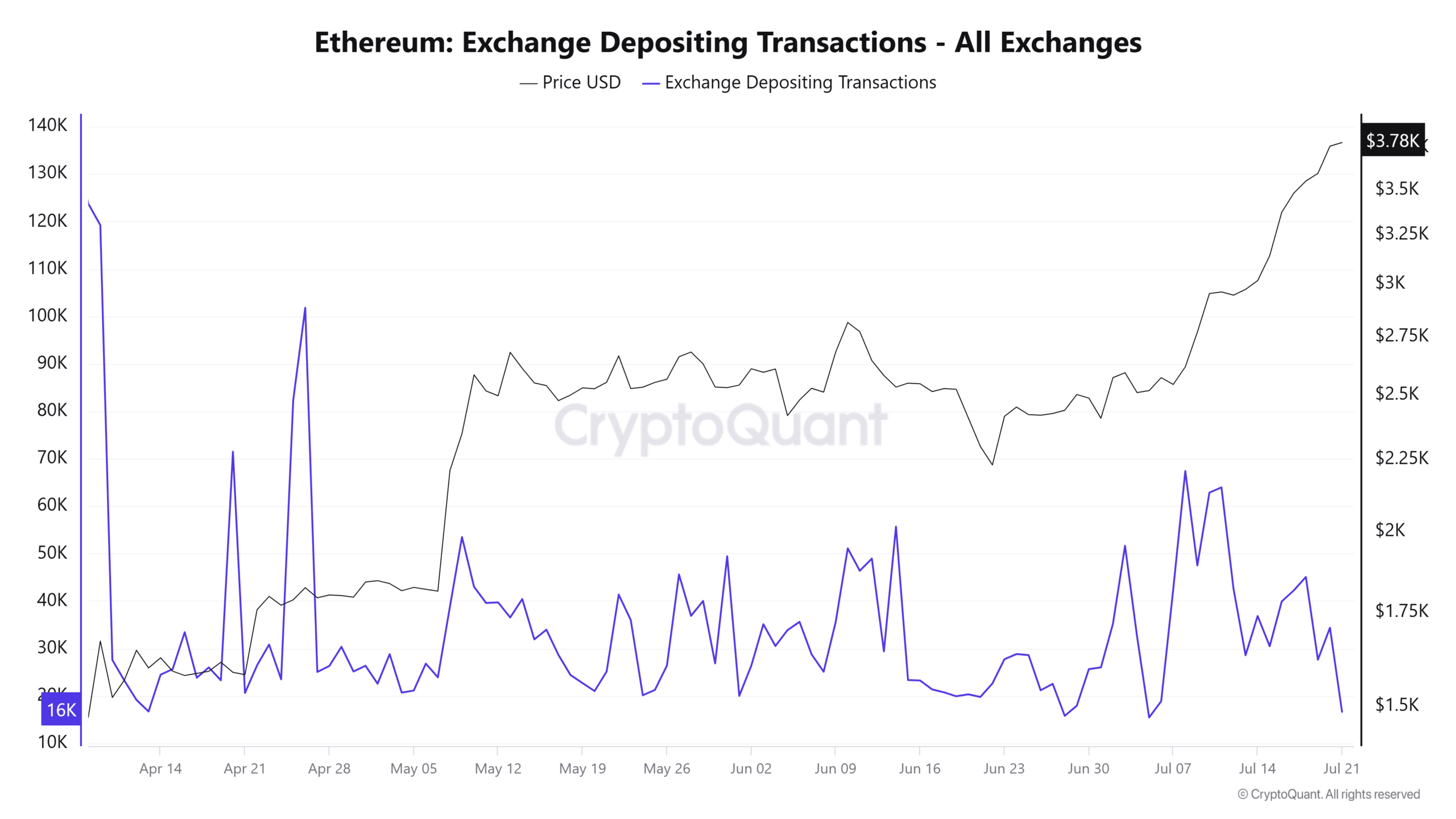

Whales make up buds, including opening long sites and transporting assets to private portfolios. The deposit addresses have decreased to only 16,000, adding to the upward pressure.

like ethereum [ETH] The edges are closer to recovering the level of $ 4000, investors put purchase orders on the original in anticipation of a possible purpose.

Pisces in particular support this narration. In fact, the width pressure near ETH deposits on the stock exchanges and the continued decrease in the stock market reserves in general may be.

The interest is rising in ETH, again!

There has been a noticeable return in whale activity over the past 24 hours.

Whales – the destroyed that controls large liquidity – affects that they affect the direction of the market through their large trading.

One of this whale, Auguila Trade, recently closed a short location on ETH after incurring more than $ 8 million of losses and then opened a long site.

according to HyperdashThe new long center deserves more than $ 128 million, and is currently getting an unintended profit of $ 631,000 at the time of the press.

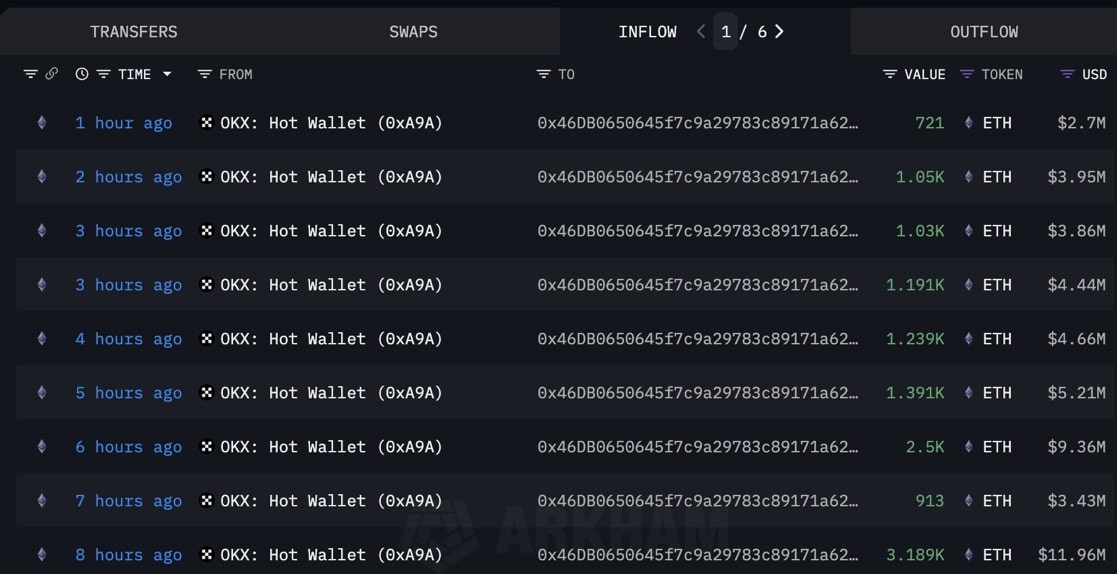

Likewise, Lokonchain stated that the last whale pulled 13,244 ETH (worth $ 49.52 million) from Crypto Exchange OKX and transferring money to private portfolios.

These transfers usually indicate long -term ups, as investors show the intention to keep them instead of selling in the short term.

Supports immediate activity and bullish feelings activity

Large flows were recorded in both the immediate market and the chain.

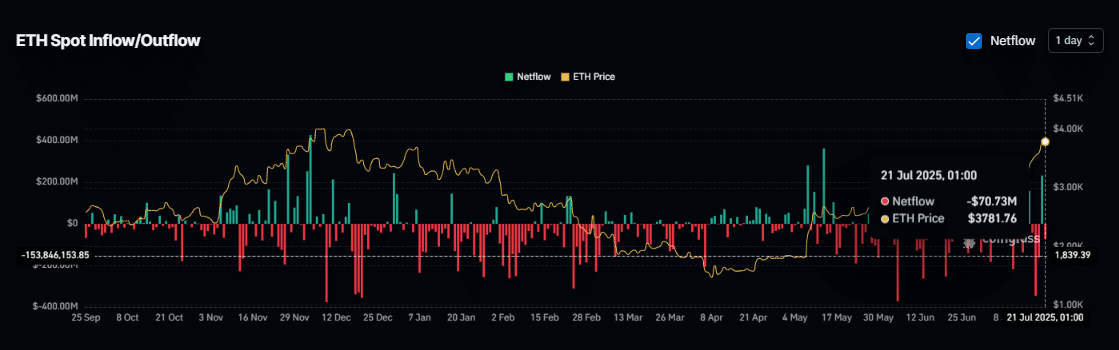

According to Coinglass’ Spot Exchange Netflow DataInvestors resisted successive sales from the previous two days.

These investors have now accumulated more than $ 70 million from ETH and transferred them to private governors, which confirms the broader market morale of the upward up.

Artemis A noticeable flow of liquidity from other Blockchains is also reported to Ethereum.

The Netflow Bridge from external ecosystems has reached $ 4 million, indicating the rotation of the capital to ETH, where the investors are likely to expect a strong mass.

In fact, activities across stock exchanges indicate more capabilities for growth, while imminent width pressures persist in construction.

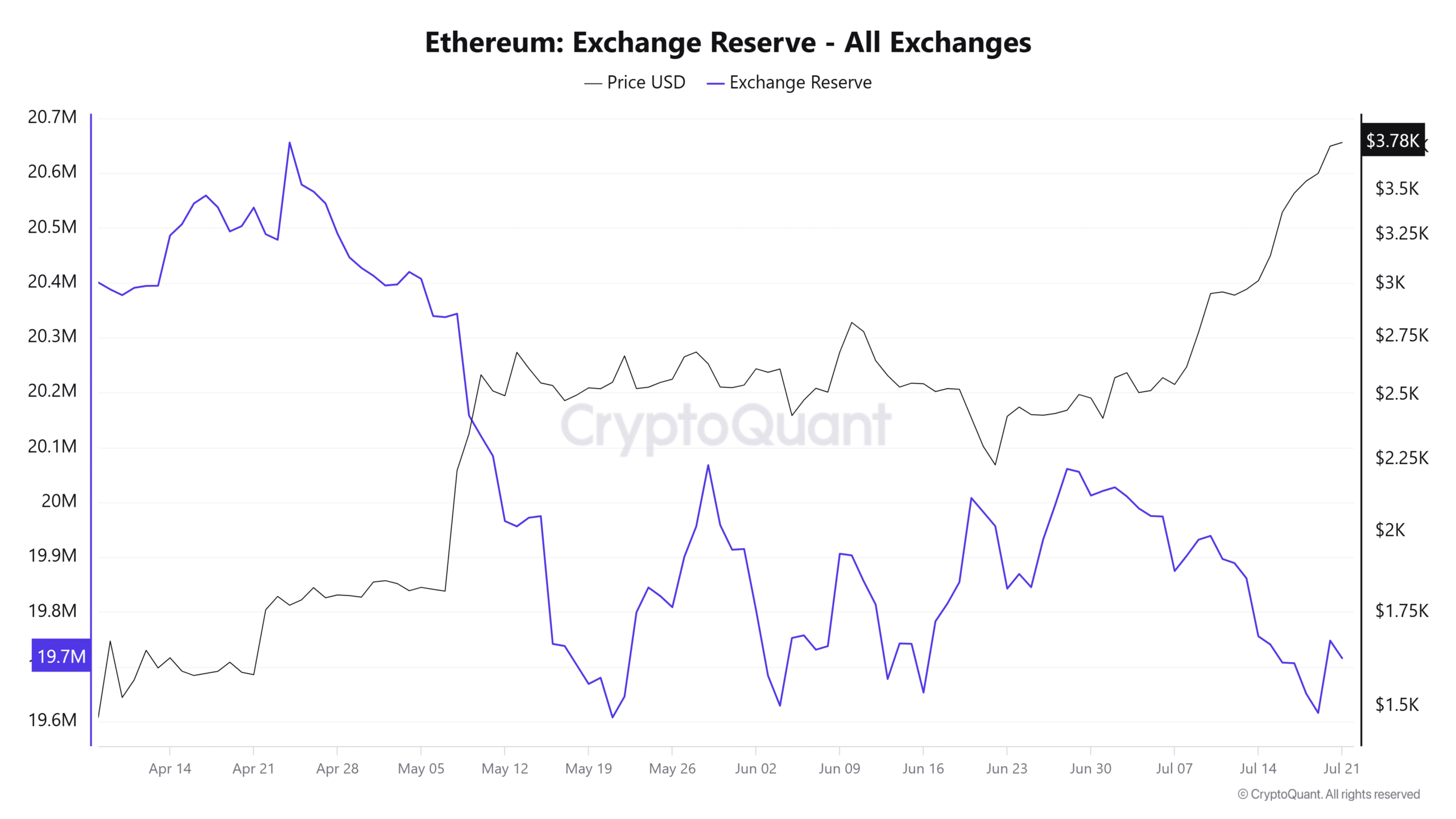

The exchange reserves decrease with deposit deposit

The amount of ETH, which was held on the stock exchanges dramatically. While the exchange reserves increased in previous weeks, they have now resumed a declining direction.

At the time of writing this report, ETH is sitting on the stock exchanges 19.7 million-which increases that investors are withdrawing their assets from the stock exchanges, which reduces the probability of sales in the short term.

In fact, the number of deposit addresses decreased sharply, reaching the last time seen on July 7.

With only 16,000 titles to deposit ETH currently, data indicates a decrease in sales activity, especially after an increase of 54 % of ETH over the past four weeks.

If this trend continues, the available ETH decrease may lead to the width pressure, which is a scenario where the demand exceeds the limited supply, which may increase the increase in prices.